Creating a fair and efficient financial services ecosystem

Table of Contents

[ show ]- Loading table of contents...

Ronan Burke

New methods for doing business have been established that allow companies to operate online, at a massive scale, and with a global customer base.

But this shift to digital during the pandemic has also created more opportunities for people to defraud banks and lenders. Financial institutions are dealing with a new generation of fraudsters, and the methods they’ve traditionally used to establish trust are not holding up.

In fact, fraud has become the single largest problem for fintech and financial services companies today: Not only have an estimated $76 billion in PPP loans been found to be fraudulent, but large enterprises like PayPal are discovering millions of illegitimate accounts within their customer base.

And all of this comes at a great expense: Every $1 of fraud loss now costs U.S. financial services firms $4.00, compared to $3.25 in 2019 and $3.64 in 2020. Synthetic identity fraud, alone, resulted in $20 billion in losses for U.S. financial institutions that year. It’s a problem on the global scale, as well, with incorrect fraud decisions costing the global economy $5 trillion each year.

So what does this mean for fintechs and other financial services providers?

Redefining our approach to risk and trust

Risk teams have traditionally relied on a mix of legacy technology and manual reviews to determine whether a customer can be trusted.

For account opening, they look to understand identity, location, or proof of business ownership. But the $20B fraud losses faced by U.S. financial institutions in 2020, alone, shows that the rise in third-party/synthetic identity fraud has made the status quo strategies outdated. Inscribe data shows that, overall, 5% of all financial application documents submitted in an online channel have been manipulated. But in 2020, the fraud rate more than doubled to 13%.

For underwriting, risk teams need to understand income or revenue, and a host of credit risks. In the past, this involved looking at data points like assets or credit scores. But those methods exclude millions of consumers: one in five Americans (approximately 62 million) are considered “thin file” with fewer than five credit accounts, and 26 million Americans are “credit invisible” due to a lack of any credit history.

What all this means is that new frameworks and fortifications are necessary to effectively fight the fraudsters of today. Businesses must rethink how they determine a customer’s trustworthiness—and they must do it in a way that doesn’t prevent authentic customers or underserved communities from accessing finances.

Inscribe’s new innovations for financial services

Inscribe was founded on the idea that we can make a more fair and efficient financial services ecosystem, and for us that started with building best-in-class fraud detection to keep criminals from gaining access.

But ‘fairness’ also means giving access to people who deserve it, so we’ve decided to expand our risk management capabilities so that businesses have more modern methods for evaluating who is trustworthy—providing more opportunity for true customers and underserved communities while still keeping their businesses safe.

And that’s why we’re releasing new features today: to make that fair and efficient financial services industry possible for businesses and consumers, alike. The AI-powered innovations detailed below enable our customers to reduce risk and save time, while also granting access to more authentic customers and underserved communities.

Expand your total addressable market with image fraud detection

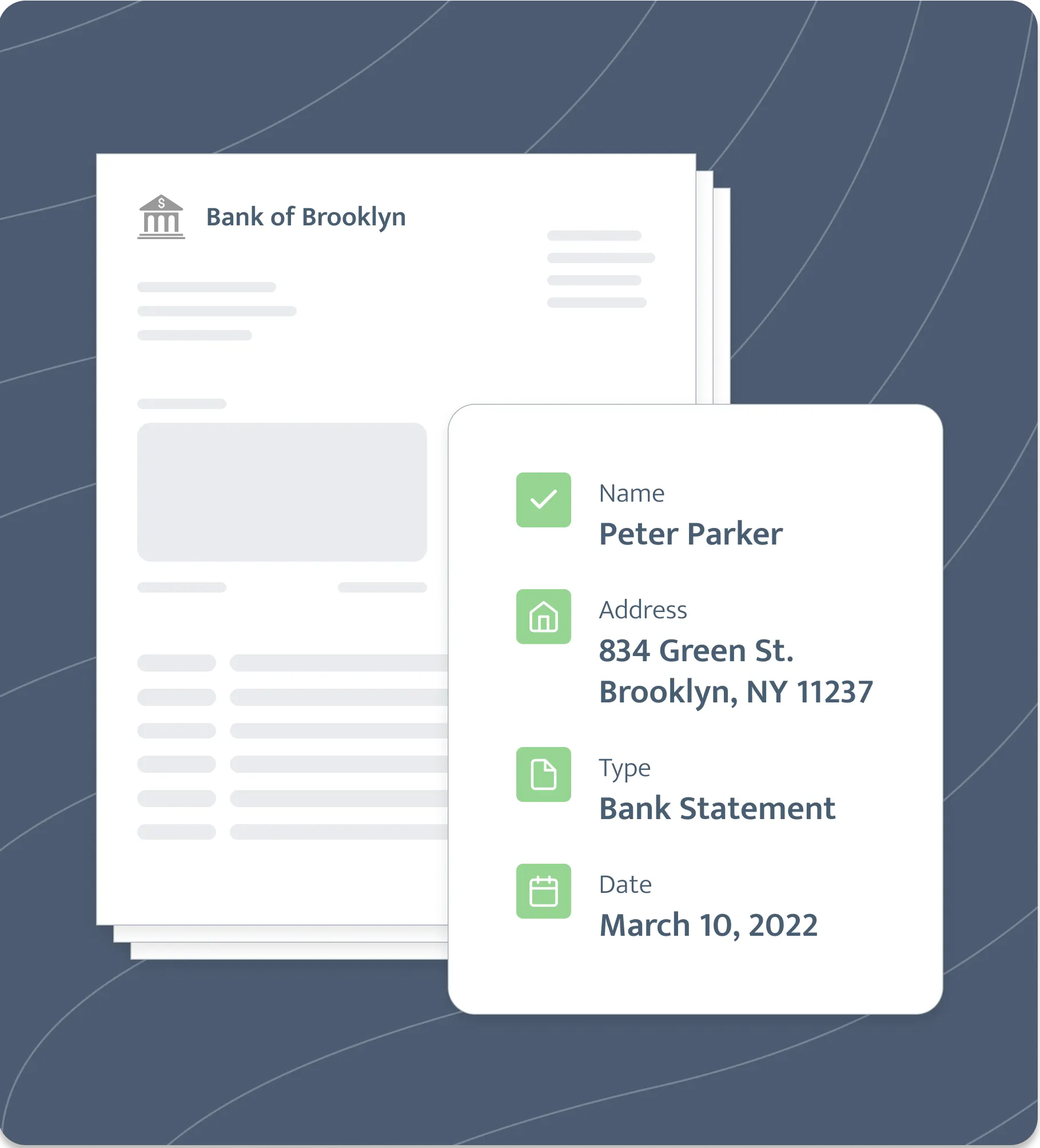

Submitting documents online during the application process is the new normal. But not everyone’s documents come digitized, and many people don’t own a scanner or fax machine in order to turn printed records into PDFs. What option are they left with? Taking a picture of their document and using that in their application.

Fraud analysts, underwriters, and operations teams need to allow their potential customers to do this, while still protecting themselves from fraud and managing their exposure to risk (as manipulating an image file with tools like Photoshop is easier than ever).

That’s where Inscribe’s image fraud detection comes in. Now, when your applicants upload photos of their documents, Inscribe can reliably review them for fraud—including whether the image has been manipulated, if the background of the image matches a previous submission, and much more. This both enables you to grant more financial access to trustworthy customers and increases your total addressable market.

Better understand your customers with credit analysis

Thin-file customers, credit invisible, non-U.S. residents, and other underserved communities are typically prevented from accessing financial products due to the barrier of credit scores. At the same time, fraudsters spend years building up the credit scores of their synthetic identities, meaning that financial institutions require a wider array of data points to understand the potential risk of granting their applicants a line of credit.

Banks, lenders, and underwriters will have the ability to do just that with our Credit Analysis feature, which analyzes transaction data to understand spending habits, identify poor money management, and more. Now, the due diligence for underwriting a loan doesn’t automatically have to discount people from these communities, and more legitimate customers can be approved in the application process.

Enhance your operational efficiency with automation

As fraudsters continue to develop new and increasingly nefarious schemes, risk teams must be able to dedicate their internal expertise to analyzing and detecting the most nuanced potential threats.

Our intelligent document processing automation allows your team members to save time and resources by taking their most tedious document review processes off their plate. You can integrate our simple API to automate the parsing, classification, and data matching on your application documents.

Secure your digital document capture with Collect

When your applicants submit documentation online or via email, the information generally isn’t encrypted and their sensitive personal data may be vulnerable during the transmission process.

But you can now decrease the risk exposure during the transit process with Inscribe’s Collect feature. Collect provides a secure and encrypted option for potential customers to upload their documents.

This feature also reduces the time it takes to go back and forth with customers until you get the correct information. If your applicants don’t send the correct documents, they’ll receive immediate feedback from Inscribe and have the opportunity to re-upload the right ones. When Inscribe does receive the proper documentation, you’ll get an alert.

Future-proof your fraud detection & document automation

At Inscribe, we’re committed to helping our customers stay ahead of fraudsters by targeting underserved or emerging problems and being the best-in-class at everything we do. If you’d like to learn more about how Inscribe helps teams automate manual reviews, reduce fraud losses, and increase decision accuracy, get started by reaching out to our team.

About the author

Ronan Burke is the co-founder and CEO of Inscribe. He founded Inscribe with his twin after they experienced the challenges of manual review operations and over-burdened risk teams at national banks and fast-growing fintechs. So they set out to alleviate those challenges by deploying safe, scalable, and reliable AI. A 2020 Forbes “30 Under 30 Europe” honoree, Ronan is also a Forbes Technology Council Member and has been featured in Fast Company, VentureBeat, TechCrunch, and The Irish Times. He graduated from the University College Dublin with a Bachelor's degree in Electronic Engineering and later completed the Y Combinator startup accelerator program.

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.