Detect forged and deepfake documents with agentic AI

Cut manual reviews by up to 90%, catch more fraud, and get clear, audit-ready decisions. Inscribe doesn't just automate tasks — our AI Agents work alongside your team as intelligent sidekicks, giving analysts the speed, clarity, and confidence to stay ahead of fraudsters.

Switch to your desktop to see the interactive product tour.

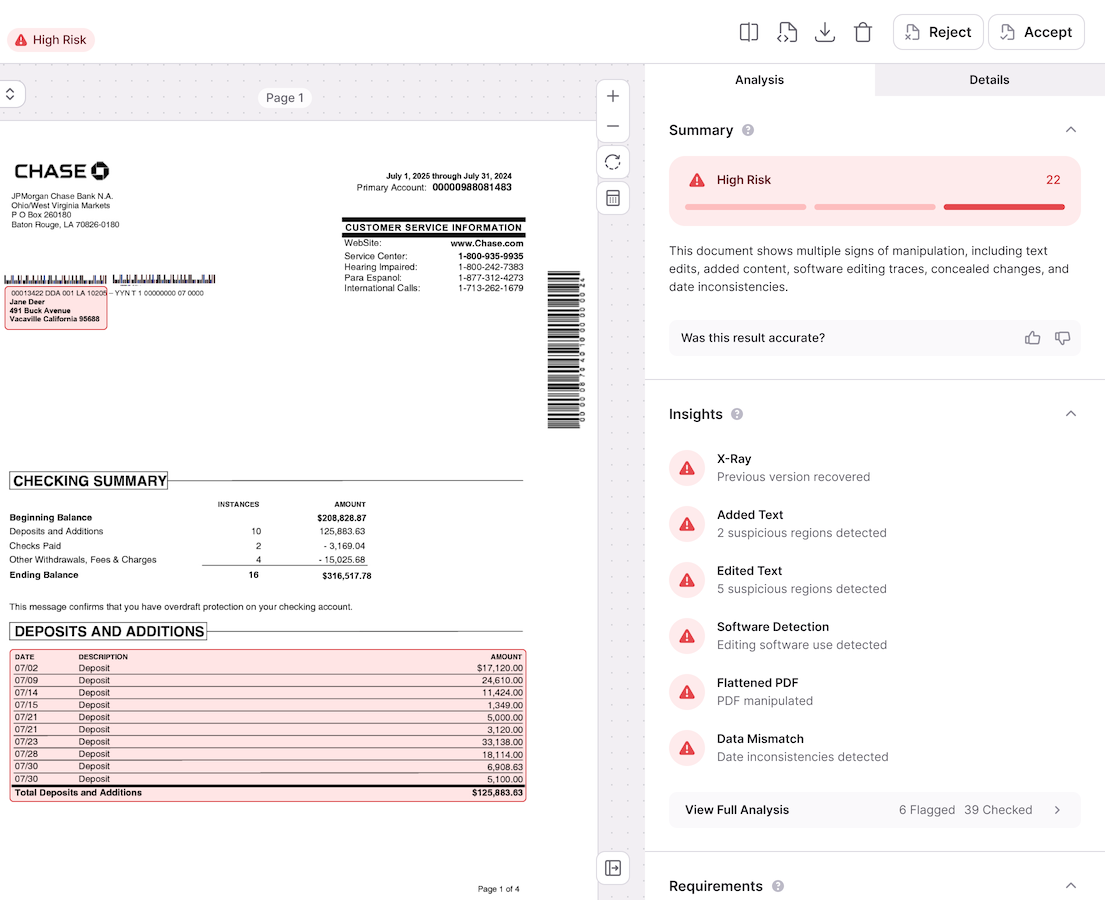

Gain a deep understanding of financial documents

Inscribe spots the subtle manipulation patterns and inconsistencies that slip past traditional systems. Our AI Agents don’t just extract data — they understand context, adapt to new tactics, and explain their findings, helping you reduce fraud losses while speeding up legitimate approvals.

Uncover every document’s unique fingerprint

By applying layered detection techniques, our agentic AI exposes fraud hidden in plain sight, including documents generated or edited with AI:

Network detection

Fraudsters often reuse the same playbook. Network detection taps into our vast library of genuine and fraudulent documents to spot recycled templates, suspicious layouts, and repeat patterns, ensuring fraud that’s worked before won’t work again.

Semantic detection

Looks can deceive, but the details rarely lie. Semantic detection cross-checks names, addresses, employment, and income to expose contradictions that don’t add up, helping you separate trustworthy applications from risky ones.

Forensic detection

Every document carries a digital fingerprint. Forensic detection analyzes structure, fonts, metadata, and file history to uncover tampering and synthetic files that manual review often misses, giving you confidence in every approval.

Perceptual detection

Some fraud hides in the smallest details. Perceptual detection examines documents at the pixel level to reveal edits, AI-generated artifacts, and subtle visual inconsistencies, so even the most convincing fakes don’t slip through.

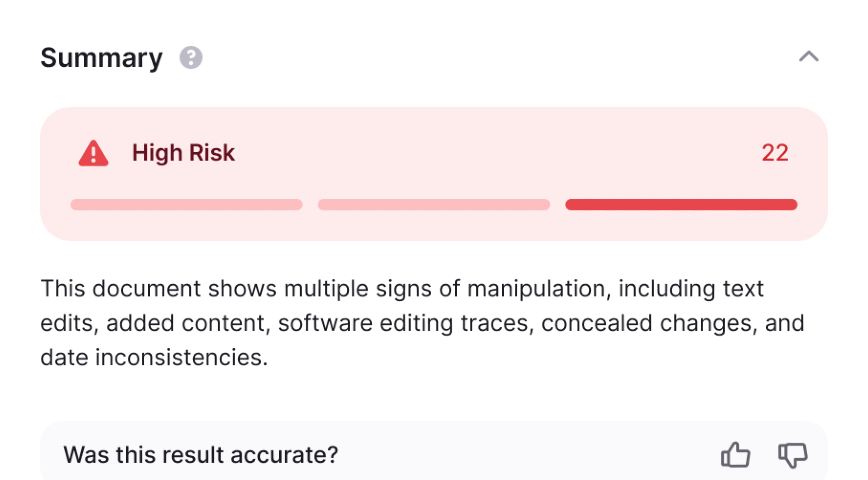

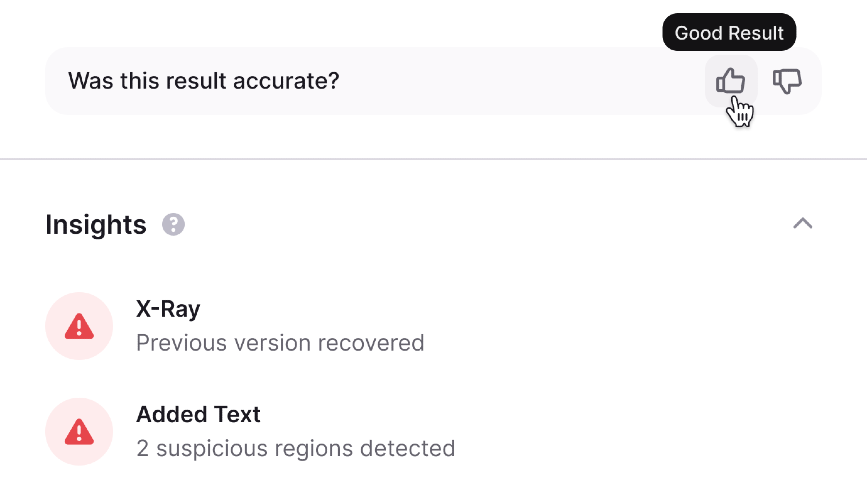

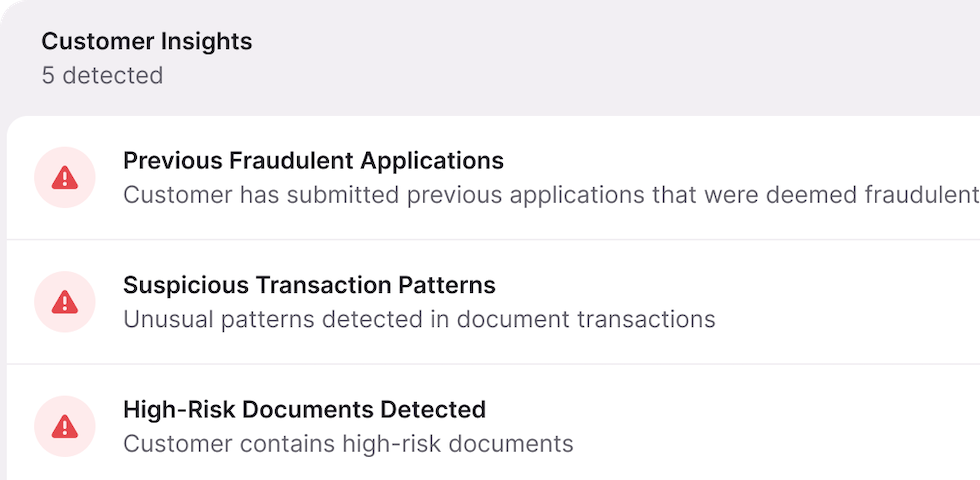

Understand risk at a glance

Inscribe's AI Agents turn complex document analysis into plain-language insights, giving your team clear, defensible explanations without digging through raw data. That means faster reviews and decisions you can stand behind.

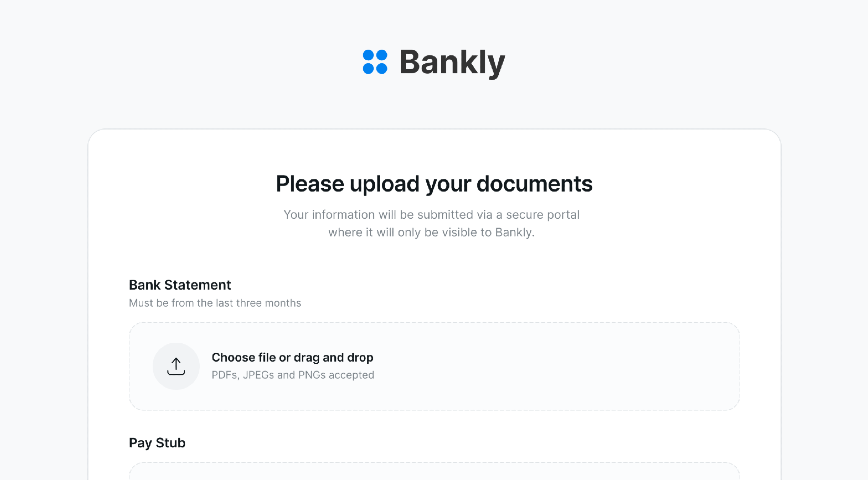

Automate repetitive document tasks

From parsing and classification to document collection, Inscribe handles the tedious, manual document review work. Your team gets more time for complex investigations and less fatigue from repetitive tasks.

Get stronger detection over time

With every review, Inscribe’s agentic AI learns from your analysts and our in-house risk analysts. The result? Sharper detection, fewer false positives, and a system that continuously adapts to new fraud tactics.

Connect the dots across documents for full applicant context

Document understanding is just the beginning. Inscribe’s AI Agents expand each investigation beyond the document itself, combining findings with external signals and third-party data to give you a complete, connected view of risk.

Verify applicant details in seconds

Inscribe’s AI Agents instantly confirm employment, validate addresses, and uncover related entities, eliminating manual lookups and copy-paste workflows so your team saves time and reduces errors.

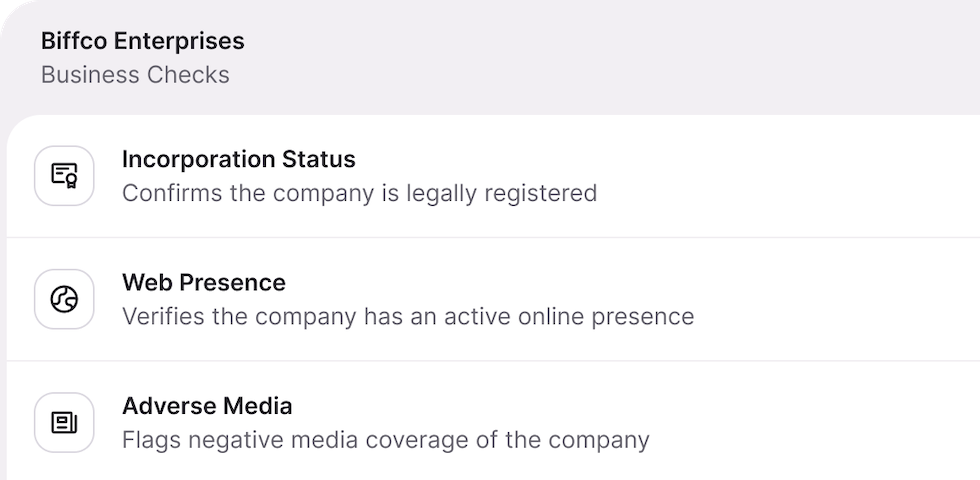

Run KYB checks automatically

Our AI Agents streamline compliance reviews by verifying incorporation status via Secretary of State records, confirming web presence, and surfacing adverse media. That means faster onboarding and stronger compliance, without the manual burden.

See the complete risk picture

By combining document-level reasoning with applicant-level insights, Inscribe’s AI Agents deliver clear, connected risk profiles, helping your team make faster, more confident decisions with all the context in one place.

How Inscribe works

Inscribe’s AI Agents review each document with the depth and judgment of a fraud analyst, but with the added speed, scale, and precision to catch hidden signals humans can’t see.

Screens

The moment a document enters your workflow (via the Collect portal, web app, or API), Inscribe pre-screens it for format validity, completeness, and type accuracy, so bad files are filtered out before they slow you down.

Validates

AI Agents enrich investigations with live research, verifying employers, cross-checking addresses, and linking external sources to document claims, giving you confidence in every detail.

Detects

LLMs extract key fields and check formatting and logic, while advanced detectors uncover hidden fraud vectors. Inscribe also surfaces risks related to transaction or balance details based on rules you configure.

Detects

LLMs extract key fields and check formatting and logic, while advanced detectors uncover hidden fraud vectors. Inscribe also surfaces risks related to transaction or balance details based on rules you configure.

Validates

AI Agents enrich investigations with live research, verifying employers, cross-checking addresses, and linking external sources to document claims, giving you confidence in every detail.

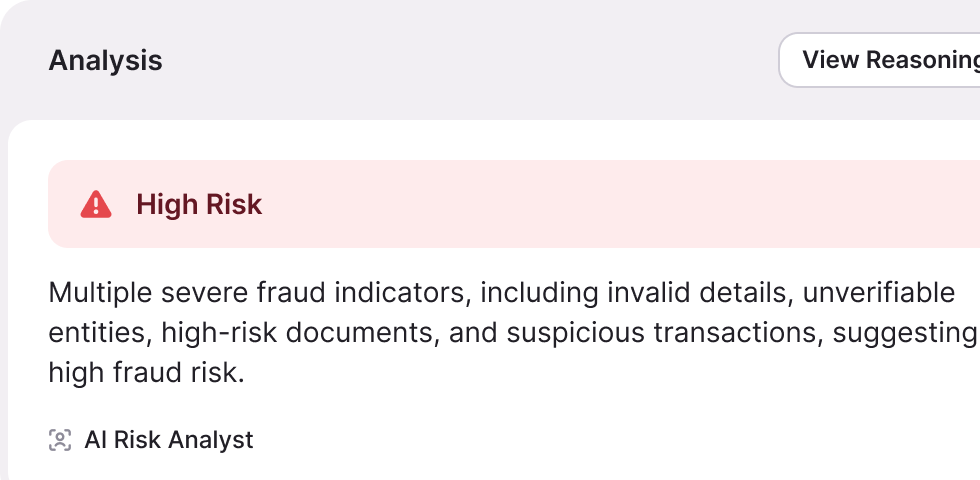

Explains

All findings are translated into a plain-language risk summary with linked evidence and contextual scoring, so your team can make faster, more confident, and defensible decisions.

Logix Federal Credit Union prevented $3M in losses with Inscribe

Challenges

Logix’s investigators struggled to keep up with rising document fraud, as manual verification methods proved too slow and unreliable against increasingly sophisticated fakes.

Solution

Inscribe automates document verification by flagging fraud, validating details, and removing the need for investigators to manually cross-check statements, balances, and employers.

Manager, Fraud Risk Management

COMING EARLY 2026

Request early access to our annual report

Learn how AI, frontier strategies, and collaboration are shaping the fight against deepfakes

2026 State of

Document Fraud

How AI, frontier strategies, and collaboration are shaping the fight against deepfakes

What will Inscribe find in your documents?

Start your free trial to catch more fraud, faster.

FAQs

What are Inscribe’s AI Agents?

Inscribe’s AI Agents are agentic AI systems built specifically to detect document fraud and assess risk. They act as intelligent sidekicks for fraud and risk teams, automating manual document review while reasoning through complex cases the way an experienced analyst would.

How does Inscribe detect forged and deepfake documents?

Inscribe uses layered detection techniques — including forensic, semantic, perceptual, and network analysis — to identify forged, manipulated, and AI-generated documents. These methods uncover subtle inconsistencies and digital fingerprints that traditional rules-based systems and manual reviews often miss.

What makes Inscribe’s agentic AI different from traditional fraud tools?

Traditional fraud tools run static rules or single-purpose detectors. Inscribe’s agentic AI can reason across documents, adapt to new fraud tactics, and orchestrate multiple detection techniques in parallel. This allows teams to detect rare, emerging, and previously unseen fraud patterns.

What types of document fraud can Inscribe detect?

Inscribe detects document forgery, AI-generated and deepfake documents, manipulated bank statements, fake pay stubs, synthetic income, false employment claims, and coordinated fraud patterns that bypass legacy systems.

How does Inscribe reduce manual document review?

By automating document parsing, classification, verification, and research tasks, Inscribe can reduce manual document review by up to 90%. This frees analysts from repetitive work and allows them to focus on complex investigations that require human judgment.

Does Inscribe explain why a document is flagged?

Yes. Inscribe generates plain-language, audit-ready explanations with linked evidence. This gives fraud, risk, and compliance teams clear, defensible reasoning behind every decision — without digging through raw data.

How does Inscribe connect document analysis to the full applicant risk picture?

Inscribe’s AI Agents go beyond individual documents by validating applicant details, verifying businesses, running KYB checks, and linking related entities. This creates a complete, connected view of risk across documents, applications, and external data sources.

Who uses Inscribe?

Banks, lenders, credit unions, fintechs, and other organizations that rely on customer-submitted documents use Inscribe to fight fraud, improve compliance, and accelerate onboarding and underwriting decisions.

How quickly can teams get started with Inscribe?

Inscribe is designed for rapid deployment and integrates into existing workflows via API, web app, or document collection portals. Most teams can go live significantly faster than with legacy fraud systems that take months to implement.