How today's smartest underwriters are streamlining their work

Table of Contents

[ show ]- Loading table of contents...

Stephanie Spangler

They’re under constant pressure to approve more customers while maintaining or improving the quality of their review process— both of which have become even more difficult in a post-pandemic world where fraud attempts have steadily increased. Eight out of ten fraud and risk professionals we recently surveyed say they’ve seen an increase in fraud attempts over the past six months.

In addition, the underwriting industry’s digital transformation has accelerated since 2020. In order to meet consumer demands, underwriters are expected to provide better, smoother, and near-frictionless customer experiences.

Many companies are solving these challenges with new technology: In a recent study by Accenture and The Institute, over 400 underwriters in North America stated that technology changes have helped them improve the following (in order):

- Speed to produce a quote

- Ability to handle larger amounts of business

- Ability to access knowledge

- Ease of doing work

- Ability to rate and price risk

Technology has undoubtedly helped underwriters, but there are still massive areas for improvement. Why? In the same study, 51% of underwriters rated their organization’s use of automation to improve the efficiency of their processes as “deficient.” Additionally, 50% rated their organization's use of AI to extract information from documents as “deficient.”

This means that there are still massive opportunities in the underwriting industry as tedious parts of underwriting workflows still remain unsolved.

Filling emerging and underserved needs in the underwriting industry

Underwriting is an involved and complex process, but many underwriters have not been equipped with the technology to automate time-consuming tasks. In 2022, many underwriters are still reviewing many documents by hand to verify key details and determine if applicants are trustworthy.

Underwriting teams need anywhere from 2-30 minutes to review a single document whereas Inscribe can review a document for them in just seconds. If an underwriter reviews an average of 10 documents per day and it takes them 15 minutes per document, that’s 2.5 hours of review time that could be reduced to just minutes — and that time could be allocated to processing more applications, giving them greater commissions and improving their job satisfaction. Plus, changes to documents through apps like Photoshop are often invisible to the human eye, and underwriters deserve tools that help them detect as much fraud as possible.

Inscribe was designed to help underwriting teams automate processes just like these while detecting fraud that can often go unnoticed. Underwriters who use intelligent document automation in tandem with AI-powered fraud detection, reduce time spent on a single application, making it possible to approve more good-fit customers while maintaining quality standards.

How underwriters are optimizing their workflows

There’s no one-size-fits-all when it comes to onboarding workflows, which is why we provide customers with an easy-to-use API for integrating Inscribe into existing systems and processes. We’ve worked with numerous underwriting teams across a variety of industries, but here are some of the most common ways Inscribe fits into underwriting workflows:

#1 To request documents upfront and throughout the customer lifecycle

Underwriters use Inscribe’s Collect feature to request documents via a secure portal that can be custom-branded with their company’s logo and color palette. Document type rules can ensure the correct documentation is provided at the time of the request. For example, is it the right type of document, is the statement from the last 3 months, etc. Collect helps reduce any back-and-forth, unnecessary delays, and frustration from applicants.

.webp)

#2 For matching details previously done by hand

Underwriters also use Inscribe to eliminate the tedious work of matching information (like names and addresses), in documents they’re requesting. What’s more? Inscribe’s intelligent document automation can parse and classify details, and is easy to set up via our API. We’ve seen it decrease manual reviews by 54%.

.webp)

#3 To detect signs of fraud and know exactly what’s fraudulent

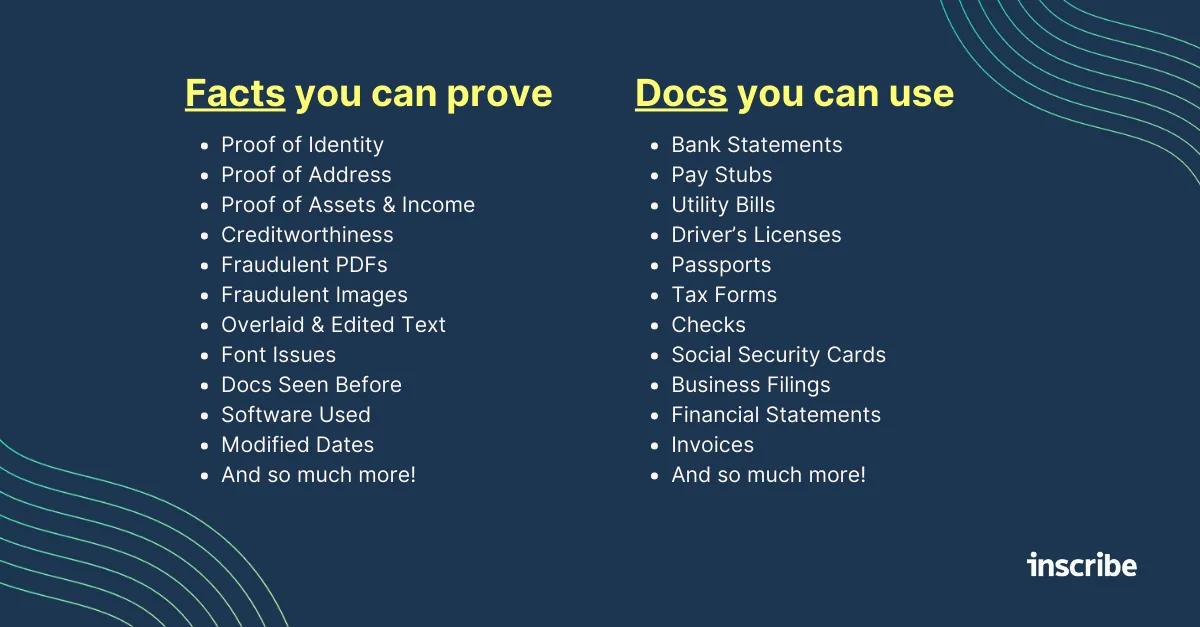

When underwriters use Inscribe to detect fraud, they are able to justify every ‘accept’ and ‘reject’ decision and maintain a detailed audit trail. Inscribe makes fact-based calls an easy reality by giving underwriters specific detail on what’s been forged in a document, if a document was created using a fraudulent template purchased online, if any software was used to modify information within a document, and more.

.webp)

#4 For credit insights outside of traditional methods

Approximately 62 million Americans are considered “thin file” with fewer than five credit accounts, and 26 million Americans are “credit invisible” due to a lack of any credit history. Inscribe is on a mission to create a more fair and efficient financial services ecosystem, and we recently launched Credit Analysis to provide underwriters with alternative insights into money management, including intelligence on non-sufficient funds activity and overdraft events. Underwriters are using this data to widen their nets and approve even more good-fit customers who may not have credit today or a very rich credit history. This also helps boost their commission potential and hence improves their job satisfaction.

A better way to approve more customers

While the underwriting industry will continue to evolve over time, Inscribe is here to accelerate the digital transformation of underwriting workflows. We’ve seen this work in fast-growing fintechs that are changing the way the industry operates, and in larger financial institutions that have started modernizing the way they do business today.

Take Michael Coomer who is a Fraud Analyst at BHG. His team adds more efficiency to their process with fraud detection and automation solutions so that when they do need to take a second look at something, they don’t have to worry about slowing down their application processing times.

“Inscribe improves the ability of an investigator like myself to efficiently review something that otherwise may take me up to an hour of time,” he said in a webinar earlier this year. “Being able to instantaneously get a highlight of potential fraud indicators from the metadata and that rich data that normally I normally have to manually review on each individual page and each individual data point on a document — it’s a huge uplift.”

If you’re ready to learn more about how Inscribe’s Fraud Detection & Automation platform can automate the most tedious parts of your underwriting workflows, contact our sales team for a custom demo.

About the author

Stephanie Spangler is the Head of Product Marketing at Inscribe, where she leads efforts to promote AI-driven solutions for banks, fintechs, and lenders. Stephanie is a seasoned product marketing leader with over 15 years of experience in driving go-to-market strategies for B2B software companies. As a three-time founding Product Marketer, she has successfully launched and scaled products in competitive markets. With experience as a product marketing consultant and previous leadership roles at Sendoso and Sage, Stephanie is known for her expertise in market analysis, customer insights, and strategic product positioning.

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.