The critical role of AI-powered fraud detection during onboarding and underwriting

Table of Contents

[ show ]- Loading table of contents...

Stephanie Spangler

Fraud risks in 2024

The answer is yes. Generative AI and large language models (LLMs) present a large opportunity for fraudsters to create and automate even more damaging attacks on banks and fintechs than ever. Research shows that the average U.S. fintech loses $51M to fraud annually, and the impact of fraud has a negative ripple effect across the entire company. While fraud losses may have been an acceptable cost of doing business in the past, this is no longer the case due to shrinking margins and the macro environment.

Our second annual Document Fraud Report, which was built after an extensive review of the documents Inscribe analyzed throughout 2023, as well as data from a survey of risk and ops leaders taken at the end of the year, revealed some additional fraud risks financial institutions need to safeguard against:

- During tough economic times, fraud attempts increase due to financial hardship. Nearly 80% of risk leaders said they saw a YOY increase in fraud attempts. More specifically, 15% saw an increase in first-party fraud, 13% saw an increase in third-party fraud, and 48% saw an increase in multiple types of fraud.

- First-party fraud has become a hidden fraud loss for many financial institutions. 94% of fraudulent application documents include alterations to non-identity details like bank balances and transaction amounts. 46% of fraudulent application documents don’t include any alterations to identity details at all.

- Effortless access to fraud-as-a-service makes it easy to understand how the number of unique fake document templates has increased by nearly 20% since last year. What’s more concerning is the majority of the templates detected were high-stakes document types — bank statements and pay stubs — likely used for securing higher loans and credit limits.

If you want to dig into the specifics of the fraud risks found, download your copy of the 2024 Document Fraud Report.

How Inscribe can help

Because fraudsters are always evolving their techniques and adopting the latest technologies, the solution needed to stay ahead is deeply technical, requires using the most innovative models, and necessitates ongoing improvements to remain effective instead of once-and-done. Risk teams need technologies that specialize in racing fraudsters to the next vector of fraud detection.

Companies that continue to build large manual risk teams will fail to scale effectively and, even worse, subject themselves to compounding fraud and credit losses. The old world of building large manual review teams is over. Our new world, enabled by machine learning, will allow risk teams to spend their time on what they are best at. The winners will embrace AI to make fast, fair, data-driven approval decisions that will ultimately benefit their customers and their bottom line.

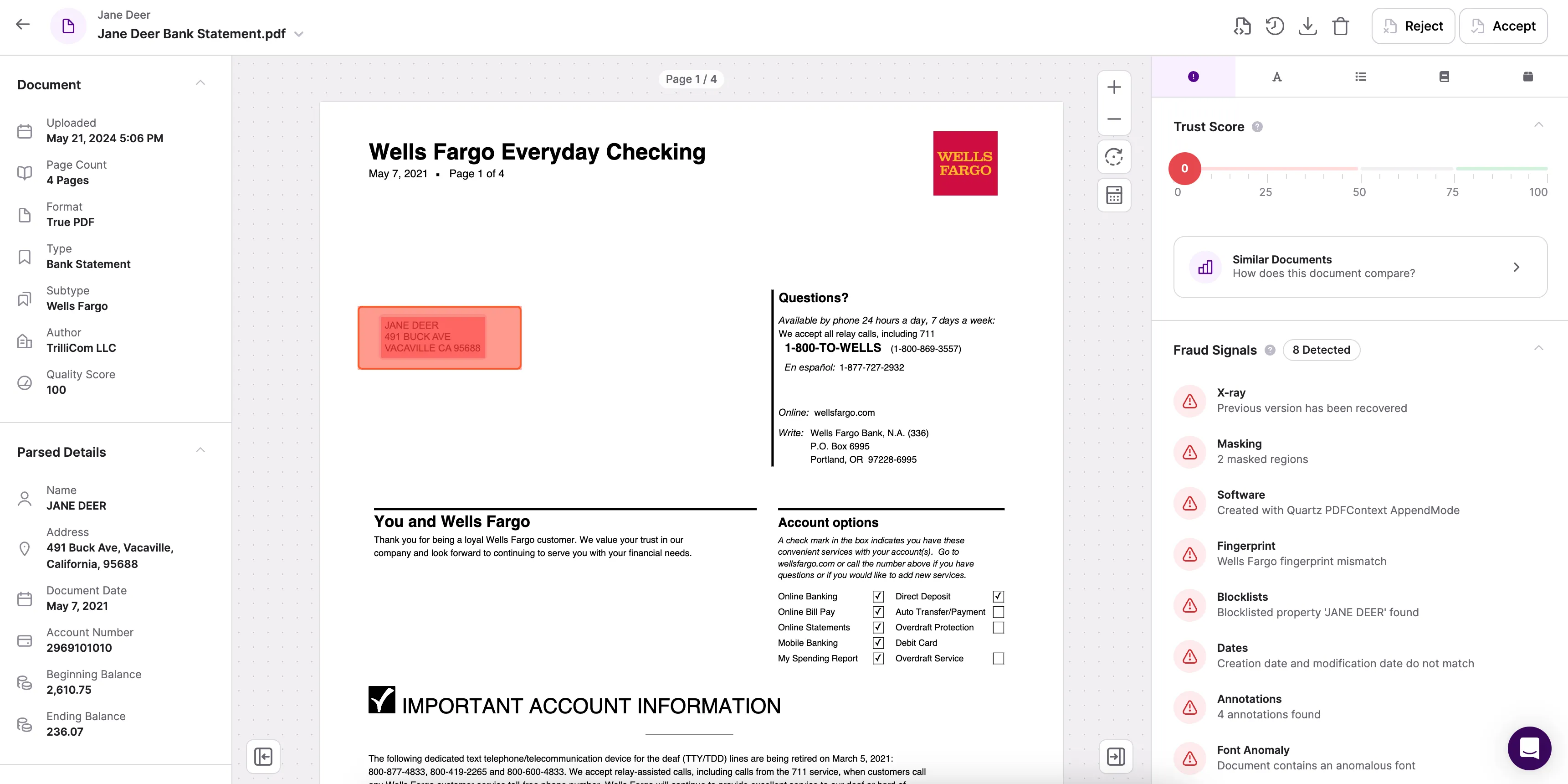

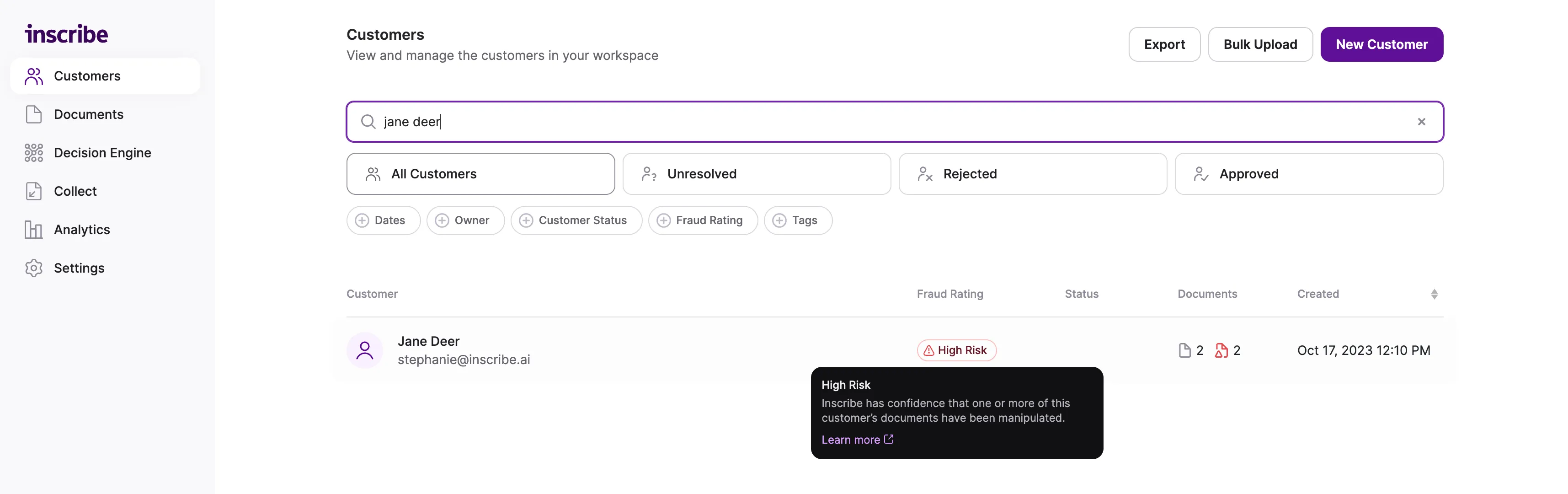

With Inscribe and the power of AI, your team will know in seconds if a document is fraudulent. Inscribe assigns a Trust Score and provides a snapshot of any fraud found, helping you quickly understand the trustworthiness of any documents received (and your applicants).

You can dig deeper by clicking into the document to see exactly where in the document fraudulent alterations were made and a detailed explanation of what was uncovered with our Fraud Signals.

Inscribe's X-ray feature even shows you if a previous version of a document exists (and what it looked like before). This feature is a customer favorite — read what Plaid, Airbase, and Bluevine had to say about it.

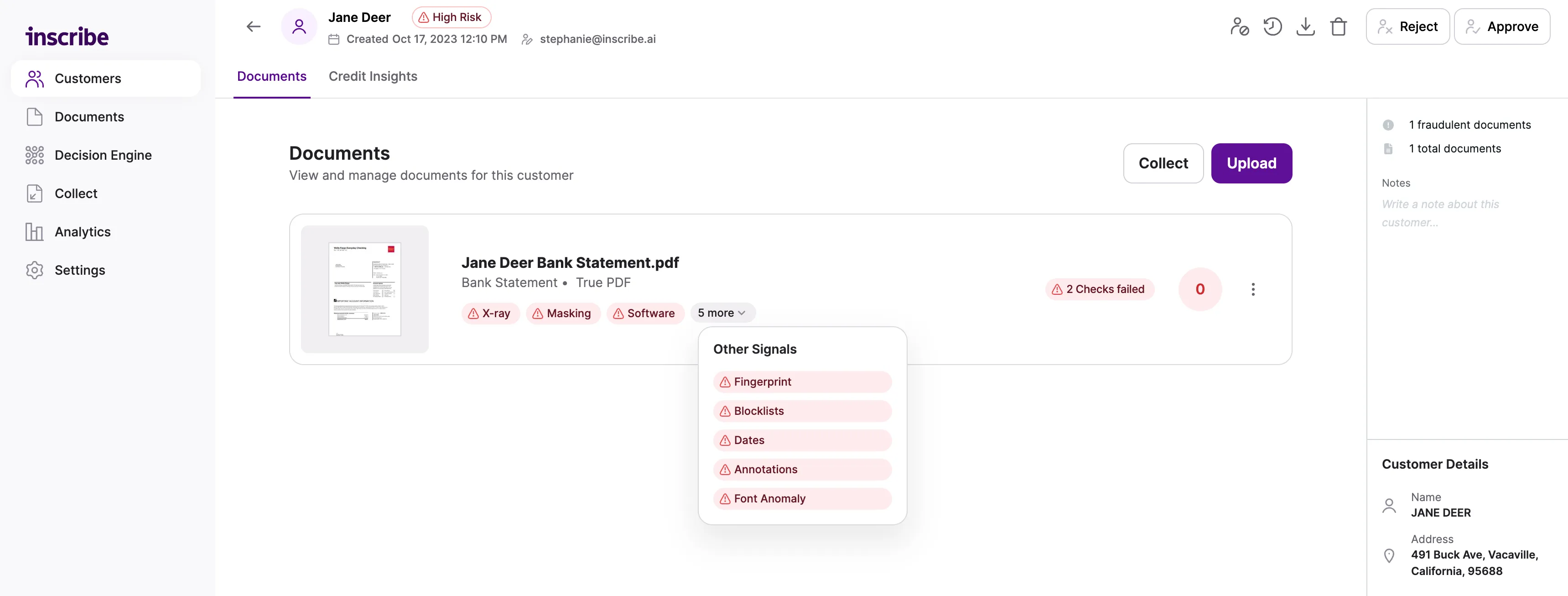

In addition to the document-level insights, Inscribe assigns a customer-level Fraud Rating to help you quickly identify whether customers are trustworthy or risky. The Fraud Rating is an aggregate rating based on the customer documents you send to Inscribe and considers each document’s classification and assigned Trust Score. A high- or low-risk rating is then assigned to the customer, helping you quickly understand how to proceed.

Ways to use Inscribe

With Inscribe, you can process your onboarding and underwriting documents automatically with our easy-to-implement API and use the web app to manually upload documents or investigate fraudulent documents further.

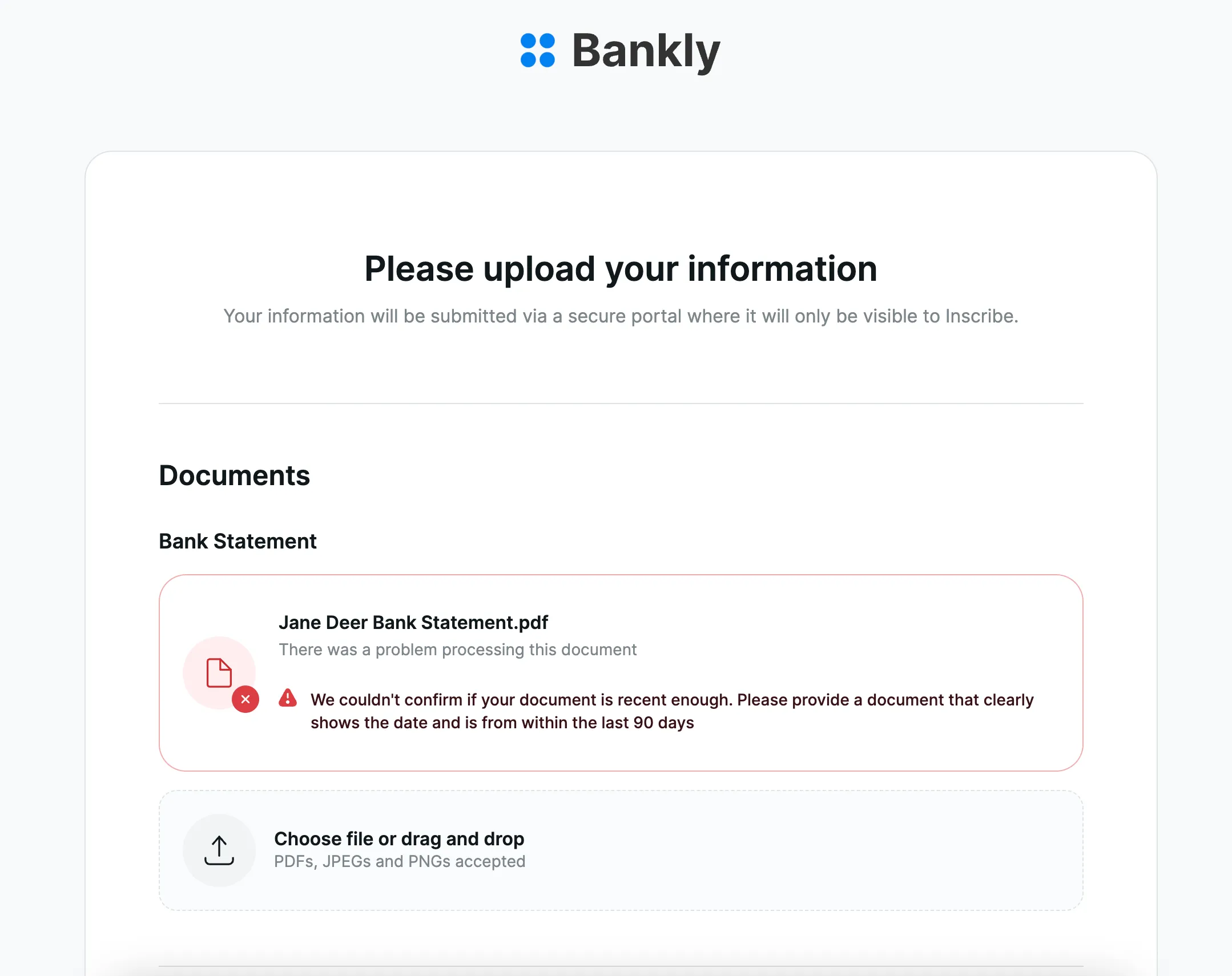

Additionally, use our secure, customizable upload portal to collect documents from your applicants. Because our portal provides real-time feedback based on criteria defined by you (as shown in the below), you can reduce back-and-forth with applicants, because real-time feedback ensures you receive the correct documentation the first time. Learn more about our document collection portal.

FAQs to help you learn more

What documents does Inscribe detect fraud on?

Inscribe supports a variety of documents used during onboarding and underwriting. These include bank statements, pay stubs, W-2s, utility bills, tax statements, and so much more.

Does Inscribe provide a fraud score?

Inscribe assigns a Fraud Rating at the customer level and a Trust Score at the document level. The Fraud Rating is an aggregate rating based on the customer documents you send to Inscribe, while the Trust Score helps you understand the severity of the fraud found within a particular document.

Why is fraud detection important?

Fraud detection is important because it helps prevent financial losses, protects personal and sensitive information, maintains customer trust, and ensures compliance with regulations. It is a critical component of risk management and helps ensure the integrity and security of financial transactions and personal information.

What types of fraud can Inscribe’s fraud detection software detect?

Our fraud detection product can detect a wide range of fraud, including identity fraud, income fraud, application fraud, document fraud, generative AI fraud attempts, and much more.

What are some benefits of using a fraud detection tool?

Some of the benefits of using Inscribe’s fraud detection product include increased fraud detection accuracy, reduced false positives, improved operational efficiency, increased win rates to due less customer dropoff, and decreased financial losses due to fraud.

Is Inscribe’s fraud detection solution scalable for businesses of different sizes?

Yes, our fraud management software is scalable and can be customized to fit the needs of businesses of all sizes, from small startups to large enterprises.

Can Inscribe’s fraud detection software be used in different industries?

Inscribe’s fraud detection product can be used in various industries, including banking, property management, finance, e-commerce, marketplaces, mortgage lending, and insurance. It can also be customized to fit specific industry requirements and compliance standards.

How does Inscribe detect document fraud accurately?

Inscribe uses the most advanced AI and machine learning technology to identify fraud. Because we created the document fraud detection category, we’ve built the largest, most diverse network of documents over time — meaning our AI models detect fraud others can’t.

Does Inscribe allow for customization?

Our Decision Engine allows you to customize Inscribe to fit your risk appetite. You can easily set document checks, adjust fraud rules, and even set new ones — no engineering work required. For example, you can set criteria to ensure you’re only accepting utility bills that were issued within the last two months, driver’s licenses that haven't expired yet, or invoices issued in the last month.

See Inscribe in action

If you want to dig deeper, there are a couple ways you can learn more. Take a self-guided tour of Inscribe with our interactive product tour or you can book a live demo.

About the author

Stephanie Spangler is the Head of Product Marketing at Inscribe, where she leads efforts to promote AI-driven solutions for banks, fintechs, and lenders. Stephanie is a seasoned product marketing leader with over 15 years of experience in driving go-to-market strategies for B2B software companies. As a three-time founding Product Marketer, she has successfully launched and scaled products in competitive markets. With experience as a product marketing consultant and previous leadership roles at Sendoso and Sage, Stephanie is known for her expertise in market analysis, customer insights, and strategic product positioning.

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.