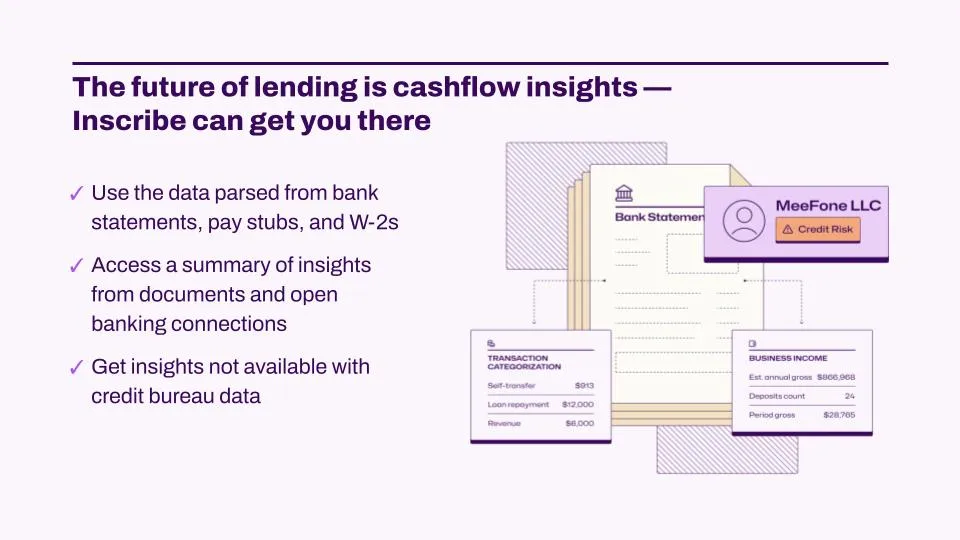

The future of lending is cashflow insights — Inscribe can get you there

Table of Contents

[ show ]- Loading table of contents...

Ronan Burke

Because of our now highly digital world, businesses work with customers from all over the globe and at higher volumes, where decisions need to be made in seconds rather than days to stay competitive. There are also many more sources of data that need to be reviewed to establish trust.

At the same time, both opportunistic fraudsters and organized criminals are adapting to new onboarding flows and, in some cases, launching coordinated attacks to take advantage of increased automation. This type of fraud can be make-or-break if not addressed.

Companies have traditionally built operations teams to review customer data for underwriting or KYC/KYB requirements. Despite the numerous changes to how we do business in a digital world, many of them still do. These teams are expensive and struggle to scale while effectively protecting a business from evolving risks. And the end result is this …

.webp)

Why manual review teams are falling behind

Last year saw a 300% increase in the weekly volume of unique fraudulent document templates detected (meaning the same documents are being used by multiple fraudsters to apply for loans and other financial products across many different institutions).

.webp)

And it’s not just career criminals: Data from our 2023 Document Fraud Report shows that 42% of all fraudulent documents only have alterations to non-identity details like bank balances, transaction amounts, and transaction descriptions. This is a sign of first-party fraud, where customers are applying under their real identity — but inflating their bank balances and hiding evidence of bad spending habits to obtain access to a larger loan or higher line of credit. They pose a significantly higher risk of delinquency.

.webp)

With image-editing software, first- and third-party fraudsters can easily alter or create fake documents, giving them an unfair advantage in gaming the manual review system. And they no longer have to live on the dark web. A quick Google search for a fake W-2, fake utility bill, or fake Bank of America statement will generate thousands of results. You can even find fake bank statement generators and websites that sell “novelty” financial documents.

But that’s not all: Social media platforms like Reddit, Telegram, and TikTok, have made it easier for fraudsters to sell document templates and share forgery techniques (see below). 61% of lenders say they’ve experienced document fraud.

Generative AI and large language models (LLMs) also present a large opportunity for fraudsters to create and automate even more damaging attacks on banks and fintechs. And the stakes are high: Research shows that the average U.S. fintech loses $51M to fraud annually, and the impact of fraud has a negative ripple effect across the entire company.

The biggest challenge for banks, lenders, and fintechs is the ongoing fight against fraud and credit risk

Fraud prevention is really a cat-and-mouse game. Because fraudsters are always evolving their techniques, the solution needed to fight fraud is deeply technical, requires using the most innovative models, and necessitates ongoing improvements to remain effective instead of once-and-done. Risk teams need technologies that specialize in racing fraudsters to the next vector of fraud detection.

.webp)

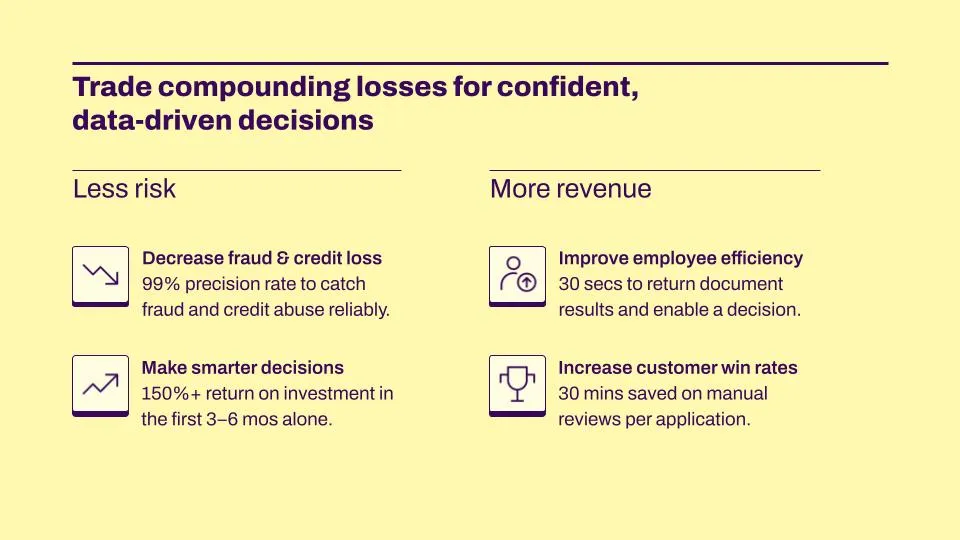

Companies that continue to build large operations teams will fail to effectively scale and, even worse, subject themselves to compounding fraud and credit losses. The old world of building very large manual review teams is over. The new world, enabled by machine learning, will allow risk teams to spend their time on what they are best at. The winners will embrace AI to make faster, fairer, data-driven approval decisions that will benefit their customers — and, ultimately, their bottom line.

A company’s ability to reduce fraud and assess credit is directly correlated with growing revenue

Risk teams are the most important function, in the most important industry in the world. They make billions of decisions per year worth trillions of dollars. By adopting artificial intelligence, they can build digital trust faster and approve more trustworthy and creditworthy customers. This ultimately reduces fraud and credit losses and ensures more equitable access to financial services.

According to Deloitte, 79% of financial institutions have said that enhancing the quality, availability, and timeliness of risk data was a top priority. Risk leaders, like cybersecurity professionals, want to enable their businesses to grow responsibly. They are looking to eliminate uncertainty about their potential customers.

At Inscribe, we care deeply about the problem of fraud because it’s a tax on economic progress, with the cost often being passed down to consumers. We have an experienced team of data scientists and engineers who operate like investigators to build models that unlock invisible document fraud signals using the latest advancements in AI technology.

Cashflow insights will power the future of fast, fair lending

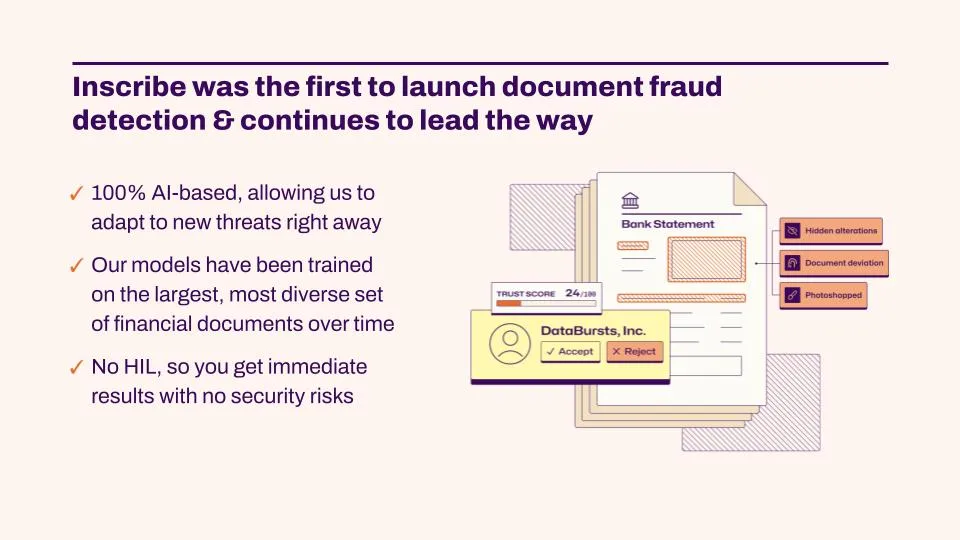

Inscribe was the first to launch a document fraud detection solution — we created the category and continue leading the way. And we recently took the next step in our evolution by introducing the Risk Intelligence category with the goal of providing you with the best performance and most actionable intelligence. How does Risk Intelligence work? I’m glad you asked.

First, Inscribe detects the undetectable.

90% of document tampering goes undetected by manual review teams. But with Inscribe, your team will know in seconds if a document includes signs of fraud, because Inscribe assigns a Trust Score to every document and provides a snapshot of any fraud signals found. This makes it easy to understand the trustworthiness of any documents received (and your applicants) at a glance. To stop repeat offenders, you can even add fraudulent names and addresses to the Inscribe blocklist and be alerted whenever they’re used again.

Then, Inscribe instantly extracts cashflow insights.

Credit bureau data is often outdated, doesn’t account for a large portion of the population, and fails to include important signals like buy now, pay later (BNPL) vendors. That’s why the future of lending is cashflow-based — but it can be extremely time-consuming. Inscribe will help your team fast-track their decision-making with access to cashflow-based data and insights, instantly. You’ll be able to consume the raw data parsed from documents and open banking data or access a summary of your borrower’s revenue or income, expenditures, risky transactions, and more in our easy-to-use dashboard.

Instead of relying on tedious, subjective, and error-prone manual reviews, teams that use Risk Intelligence software are equipped with AI-powered fraud and credit insights that eliminate uncertainty and make risk decisions easier.

Inscribe has always utilized the most sophisticated technology available, including machine learning and LLMs, since our inception. We work to deliver safe and usable artificial intelligence solutions for financial services that protect them from increasingly sophisticated fraudsters.

And because Inscribe is 100% built with AI and machine learning you don’t need to worry about the security risks, subjectivity, and errors of manual review. Our models perform like your most seasoned investigators, adapt to new threats immediately, and provide results in seconds without offshore security risks.

Start reducing risk and growing revenue today

The future of lending is cashflow underwriting, and Inscribe can get you there by checking applicant data for fraud risk, parsing and categorizing that data, and summarizing key financial health insights that make it easy for you to make better and faster lending decisions.

The results of utilizing Risk Intelligence are clear …

And the cost of waiting to make a change is too great. Take your first step to reduce fraud and credit losses with an end-to-end Risk Intelligence solution by reaching out to speak with a member of our team. (Or, test drive Inscribe yourself with an interactive tour.)

About the author

Ronan Burke is the co-founder and CEO of Inscribe. He founded Inscribe with his twin after they experienced the challenges of manual review operations and over-burdened risk teams at national banks and fast-growing fintechs. So they set out to alleviate those challenges by deploying safe, scalable, and reliable AI. A 2020 Forbes “30 Under 30 Europe” honoree, Ronan is also a Forbes Technology Council Member and has been featured in Fast Company, VentureBeat, TechCrunch, and The Irish Times. He graduated from the University College Dublin with a Bachelor's degree in Electronic Engineering and later completed the Y Combinator startup accelerator program.

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.