The next wave of AI-generated document fraud

Table of Contents

[ show ]- Loading table of contents...

Stephanie Spangler

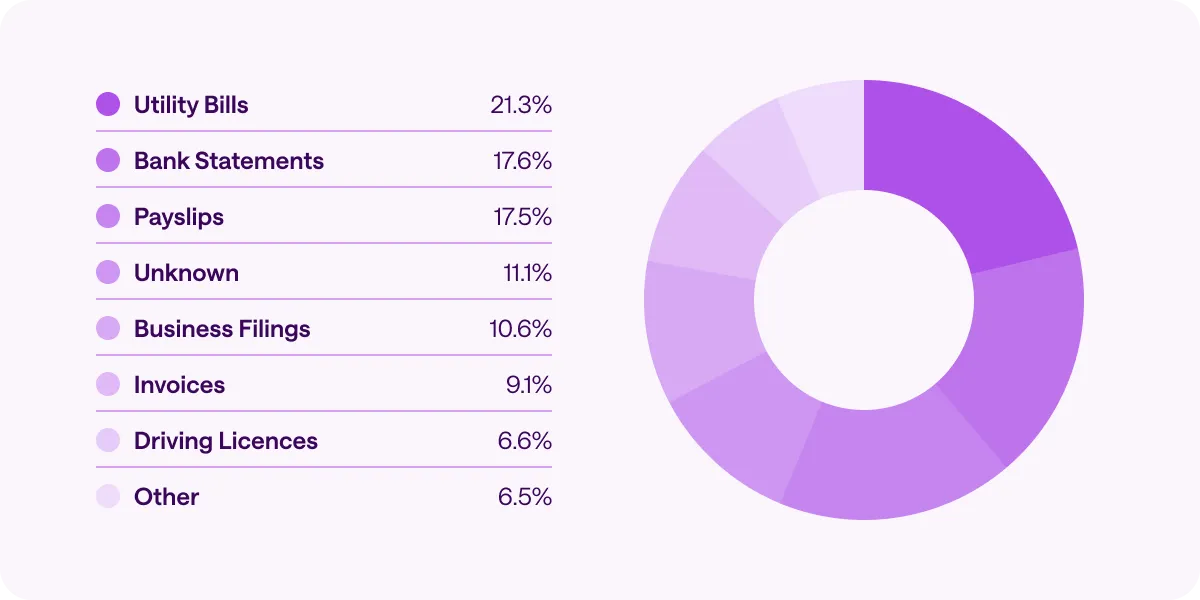

Back in May, we shared an update on the rise of AI-generated and template-based document fraud. At the time, the top three AI-generated document types we flagged were utility bills (38%), invoices (18%), and bank statements (14%).

Just a few months later, the landscape has shifted and the threat has only grown more sophisticated.

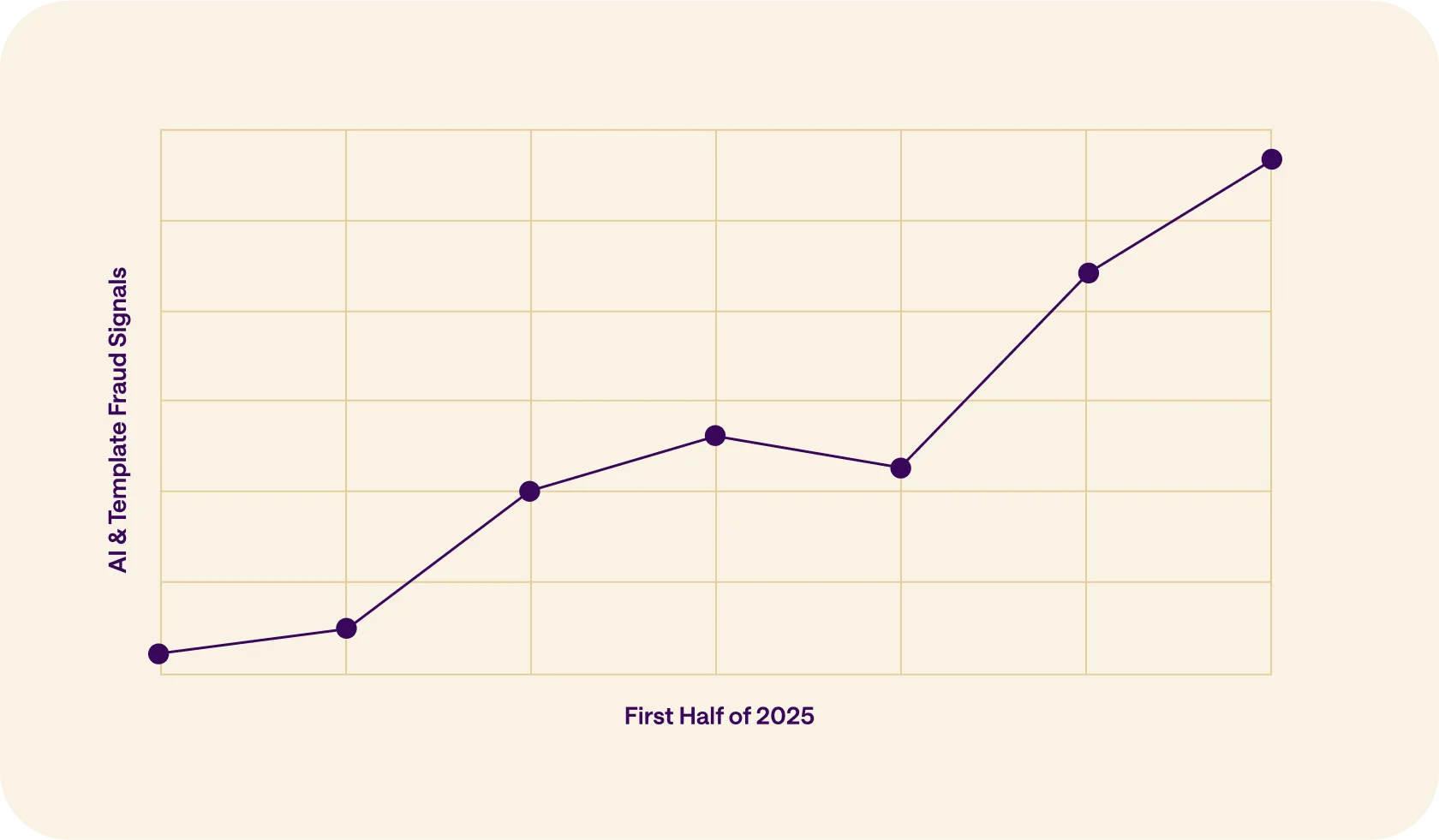

AI-generated fraud is accelerating

AI-generated and template-based document fraud is up 208%. What once required advanced technical skills can now be pulled off with off-the-shelf tools. Generative AI, editable templates, and fraud-as-a-service platforms have lowered the barrier to entry, making document fraud one of the most complex and fast-growing forms of financial crime today.

In a recent interview, Michael Coomer, Director of Fraud Management at BHG Financial, described how manipulated documents had been a recurring challenge for his team prior to using Inscribe, with reviews often relying heavily on individual expertise. His experience underscores why AI-edited documents — which can look completely genuine to the human eye — are so difficult to catch without automation.

Two clear AI fraud patterns

At Inscribe, we’re seeing two main patterns of AI-driven document fraud:

- AI-generated documents: Created entirely from scratch with image models. These are often still easier to flag with the right detectors, since they tend to look too perfect. Logos might be slightly off, fonts may include strange characters, and subtle anomalies in formatting, metadata, or images can reveal the fraud.

- AI-edited documents: Real files that fraudsters modify using generative tools to change just a few fields — names, dates, or amounts. These are more dangerous in the short term because most of the document is genuine. And with newer models, these edits are becoming harder to detect, often slipping past manual review — and tools that aren’t continuously updating their detectors.

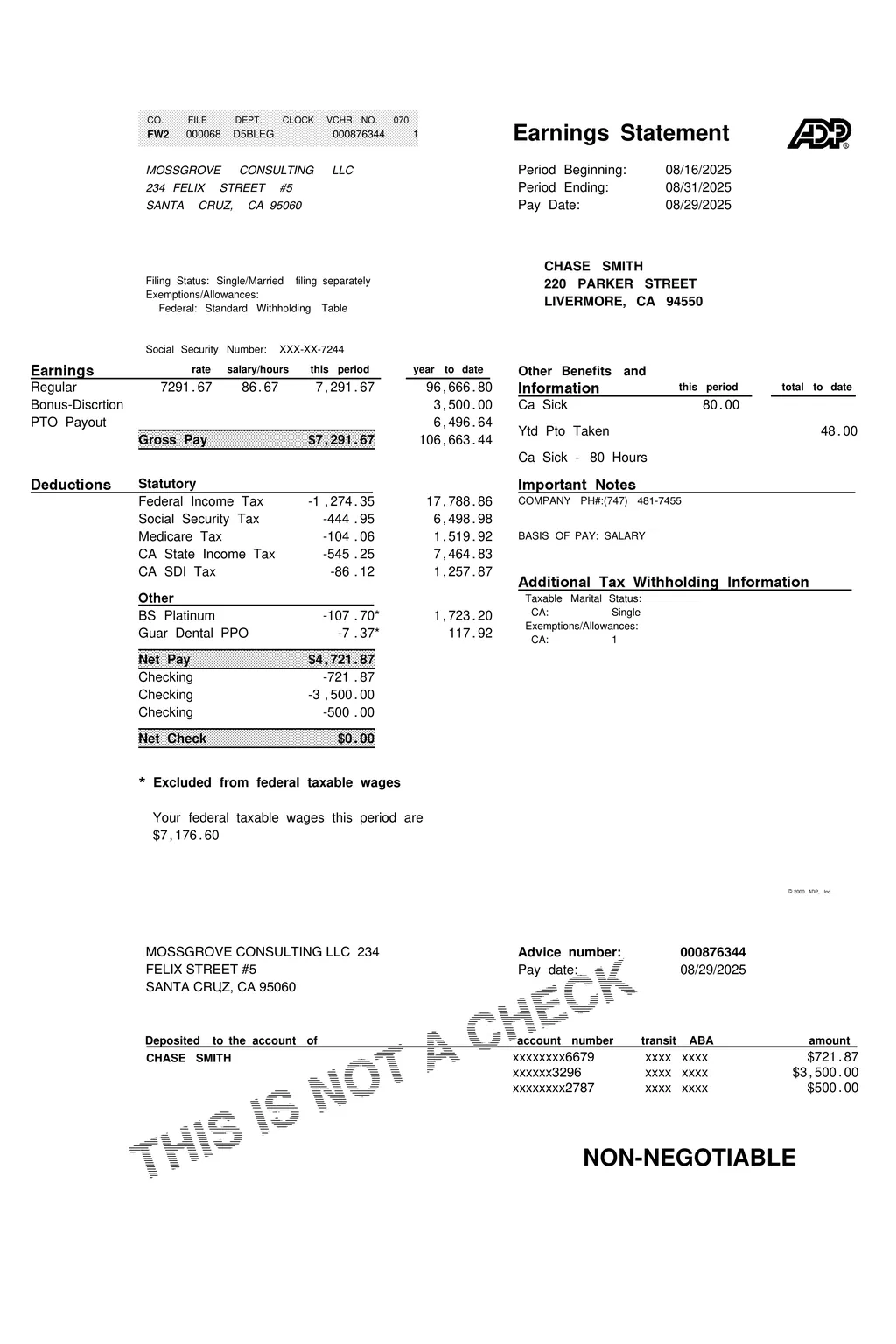

This second category is especially concerning, because a document that’s mostly real but slightly manipulated is far more convincing than one created from scratch. For example, does this document look legitimate to you? We'll cover if it is or isn't shortly...

Shifting document types

The mix of AI-generated documents we're flagging has also shifted. The most common document types are now utility bills (21.3%), bank statements (17.6%), and payslips (17.5%) — documents commonly relied on to prove address, verify income, and validate employment.

Staying ahead of deepfakes

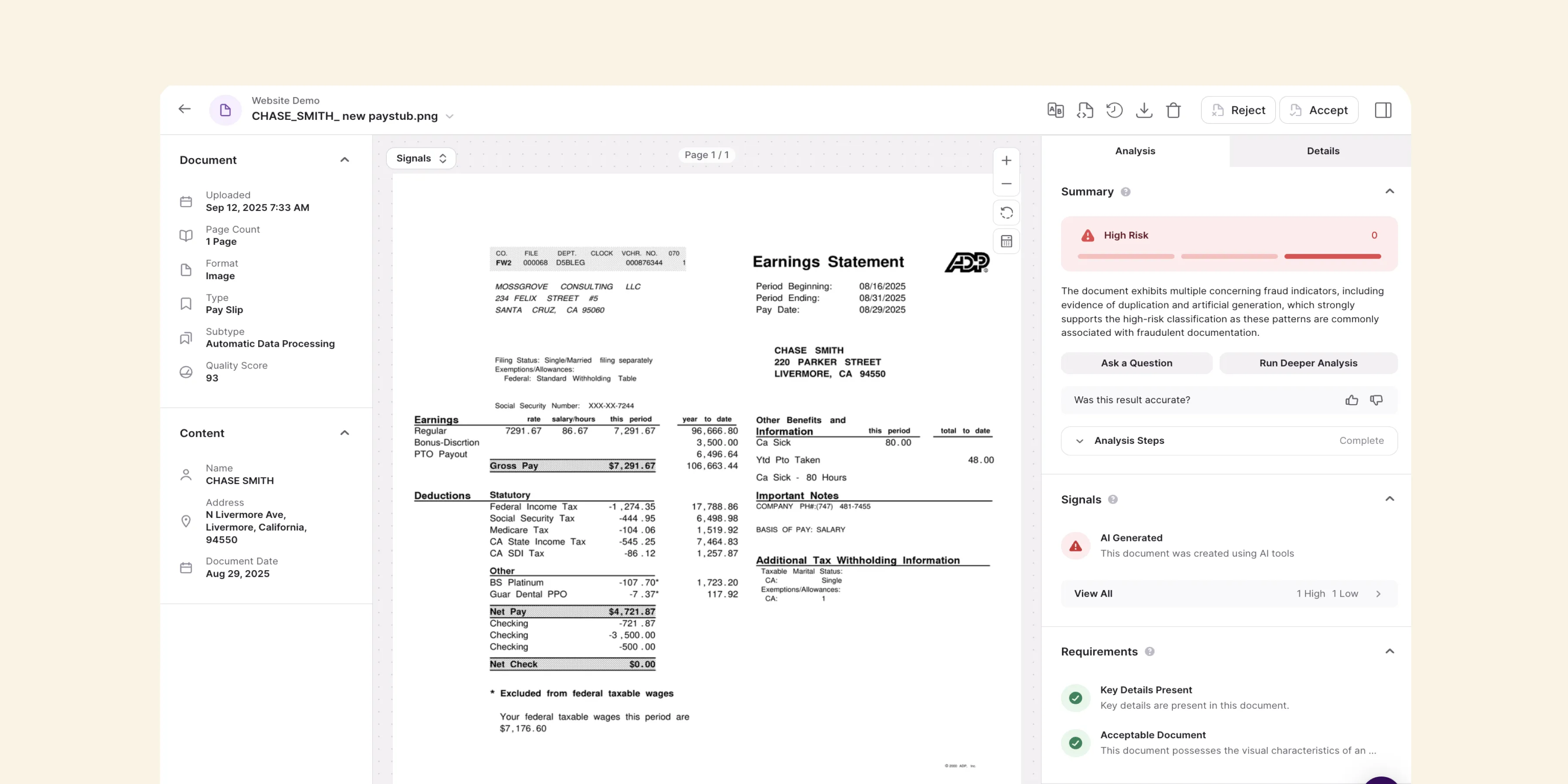

To stay ahead of these tactics, we’ve updated our AI Generated detector to catch the latest forms of both AI-generated and AI-edited documents, including those created with advanced models like GPT-5.

Here's the same document shared above, but sitting inside the Inscribe web app where it's gone through analysis by our AI Agents. It is in fact AI-edited, which Inscribe flagged, but looks exactly like a real ADP paystub.

During a recent interview, Jorge Cortes, VP of Enterprise Risk Management at Kinecta, explained how these capabilities have become critical as fraudulent documents grow more convincing with AI, helping his team spot risks that would otherwise slip by.

These updates ensure our customers remain protected against the newest fraud tactics, especially as generative AI continues to evolve so quickly.

What this means for fraud leaders

Fraud tactics will continue to evolve, but one thing is clear: manual review alone cannot keep up with the speed and subtlety of AI-generated and AI-edited document fraud. With Inscribe, you can reliably catch these deepfake documents while also cutting manual reviews by up to 90%.

But staying ahead isn’t only about technology — it’s also about staying connected to one another and to what’s happening across the industry. That's why we’re teaming up with Hailey Windham, founder of CU Fight Fraud, at Money20/20. Hailey speaks with risk leaders every day about the challenges they face and the tactics bad actors are using, and she’s offering free 1:1 consultations at the event to share best practices. To reserve your spot, just email marketing@inscribe.ai.

If you're not using Inscribe today and want to see how it performs on your documents, get in touch with our team to try it free.

About the author

Stephanie Spangler is the Head of Product Marketing at Inscribe, where she leads efforts to promote AI-driven solutions for banks, fintechs, and lenders. Stephanie is a seasoned product marketing leader with over 15 years of experience in driving go-to-market strategies for B2B software companies. As a three-time founding Product Marketer, she has successfully launched and scaled products in competitive markets. With experience as a product marketing consultant and previous leadership roles at Sendoso and Sage, Stephanie is known for her expertise in market analysis, customer insights, and strategic product positioning.

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.