What to Look for in Fake W2 and 1099 Forms Online (and How to Catch Them Instantly)

Fraudsters use fake W2 and 1099 forms to steal identities and commit tax scams. Learn how to detect red flags and how Inscribe’s AI helps banks spot fake documents instantly.

Table of Contents

[ show ]- Loading table of contents...

Brianna Valleskey

Without the right technology, it’s easy for businesses to mistakenly pass fake W-2 forms as valid.

Identity thieves and organized crime rings use the information on these forms to claim unemployment benefits in others’ names. This includes stealing the victim’s name, address, Social Security number (SSN), annual wage details, withholdings from income taxes, and benefits.

In most cases, victims of these scams are unaware of an identity breach. But that’s not all. They may also receive a 1099-G tax form in the mail detailing benefits they didn’t receive.

Such fraud surged during the coronavirus pandemic, when many people fell victim to unemployment fraud during tax filing season.

Thieves posted erroneous wages on fake W-2 forms using their victims’ names and employment identity numbers (EINs), siphoning more than $87B in federal unemployment benefits. The employment identity number, also known as the employer identification number, is a key tax identification number on W-2 forms and is often manipulated or stolen by fraudsters to create fake documents.

As fake W-2 forms become a nationwide problem, it’s crucial for banks and financial institutions to know how to verify one. Verifying a borrower's income is essential for lenders and property managers to ensure loan eligibility and reduce risk.

Fake W-2 forms often contain erroneous wage information and manipulated withholdings, including federal income tax, which can mislead institutions and authorities.

Common signs of fake forms include blurry text and spelling errors, which can indicate document tampering or low-quality forgeries.

Introduction to fake forms

Fake forms (such as W-2s and pay stubs) are an escalating challenge for financial institutions, government agencies, and individuals alike. These fraudulent documents are often used to illegitimately claim tax refunds, secure loans, or access government benefits, leading to substantial financial losses and undermining trust in the system.

Verifying income and employment history is more important than ever. When financial institutions and government agencies receive W-2 forms or pay stubs, they must ensure these documents accurately reflect the applicant’s employment and income. Failing to do so can result in fraudulent tax filings, improper benefit payments, and significant reputational and financial damage.

As fraudsters become more sophisticated, the responsibility to verify employment and income details falls on both organizations and individuals to protect themselves and the broader financial ecosystem.

Detect fake W2s and 1099s in seconds

With fraudsters using fake tax documents to claim unemployment benefits or secure unqualified loans, verifying W2s and 1099s is more crucial than ever. But manual review is slow, error-prone, and expensive.

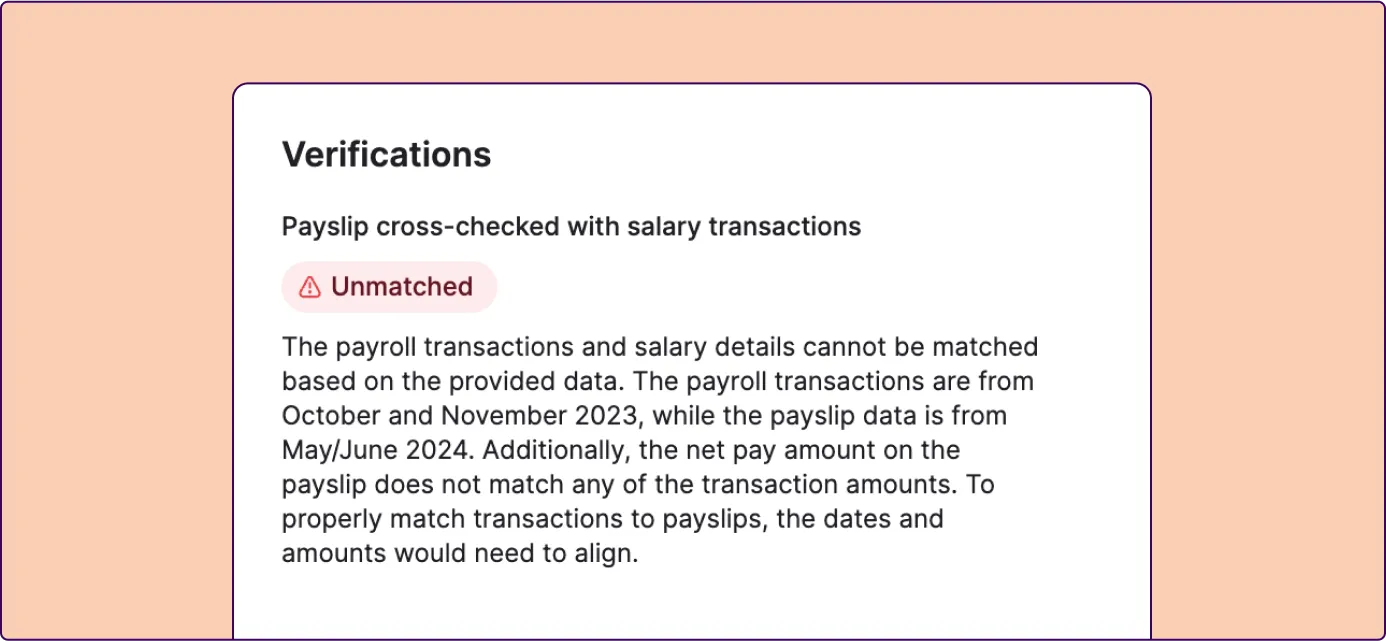

Inscribe uses AI agents trained on thousands of authentic and fraudulent documents to automatically detect inconsistencies, manipulations, and forgeries at superhuman speed.

From mismatched income data and unusual formatting to suspicious SSNs and document edits, Inscribe flags the red flags so your team doesn’t miss them.

Take a quick interactive tour to see how Inscribe catches fake W2s and 1099s before they reach your analysts.

Why do banks and lenders ask for 1099 and W-2 forms?

Banks and lenders require 1099 and W-2 forms to confirm an applicant’s income and ability to repay loans. These documents are critical for underwriting, especially when making decisions about mortgages, credit lines, and small business loans.

- W-2 forms provide a reliable snapshot of employment-based income. They show gross wages, taxes withheld, and employer details—all of which help lenders validate salary claims and employment consistency. W-2s also detail salary compensation, including bonuses, tips, and other earnings that contribute to total income.

- 1099 forms, on the other hand, reflect non-traditional income. This could include freelance work, consulting gigs, rental income, dividends, or other earnings outside a standard job. Lenders review these forms to understand the full picture of an applicant’s financial health.

Since the 2008 financial crisis, regulatory scrutiny has forced financial institutions to be more rigorous. Today, it’s not enough for a borrower to self-report income—lenders must verify it through credible, third-party documentation like W-2s and 1099s. Lenders are now required to request supporting documentation to verify income and employment claims.

Unfortunately, fraudsters have caught on. They know lenders rely on these forms and have found ways to exploit the system. That’s why it’s essential for banks to detect fake documents before they lead to losses. Banks and lenders should double check all submitted forms for inconsistencies or signs of fraud.

How do banks and lenders use 1099 forms?

While 1099 and W-2 forms are solely for annual income tax return purposes, not everyone sees them that way.

Fraudsters (identity thieves, cybercriminals, and other scammers) create false 1099s and fake W-2 forms and commit fraud. Submitting incorrect information on these forms can lead to audits, penalties, or fraud investigations.

For example, Patrick Poux, a former Brooklyn resident, created fake W-2 forms with excessively high federal income withholdings to gain millions in fraudulent refunds through shell companies he managed. Poux pleaded guilty to garnering about $3M in tax returns and Covid-relief funds: money which he spent on a life coach and luxury shopping.

Breon Peace, the U.S. Attorney who pursued the case against Poux, said he admitted to “preparing and filing false applications for millions of dollars” in tax and COVID-19 disaster relief funds. Yet Poux’s tax-related identity theft scam is just one among many fake W-2 form schemes defrauding U.S. taxpayers.

Some cybercriminals launch scams through phishing emails that seek to draw sensitive employee information from people in authority, including chief operating officers. The fraudsters pose as executives and send emails to finance or payroll personnel requesting copies of employees’ W-2 forms.

Initially, the fraudsters send friendly emails, then ask for all Form W-2 and employment details. Several reported cases show that once they get the data they want, they either:

- Use it to file fraudulent tax returns

- Follow-up with a request for a wire transfer

- Post it for sale on the DarkNet

Some criminals go to great lengths to lure their victims, offering seemingly legitimate “tax services” designed to separate them from their money, identities, or anything of value within their reach. The goal is to steal the victims’ identities and tax refunds.

These scams might even include fake tax forms or websites that mimic the Internal Revenue Service (IRS) to trick the victim into disclosing personal or work-related information.

The IRS regularly cautions taxpayers against such scams by publishing its annual “Dirty Dozen” list.

Some of these schemes are disguised as debt payment options for mortgage or credit card debt. For example, victims might be asked to fill out:

- Form 1099-MISC

- Miscellaneous Income scam

- Bogus bonded promissory notes

- Bonds

- Worthless checks

The con artists provide fake Form 1099s or W-2 forms that appear to be issued by a large mortgage company, loan service, or bank the victim may have had a prior relationship with.

How do banks and lenders use W-2 forms?

W-2 forms are a cornerstone of income verification for banks and lenders. These documents, issued annually by employers, outline an individual’s total wages, as well as the taxes withheld throughout the year. Because they come directly from an employer and are submitted to the IRS, W-2s are considered a trustworthy source of income data.

Lenders use W-2s to:

- Verify employment history and ensure consistency across multiple years

- Confirm gross income—W-2s also report taxable income, which is used to calculate tax obligations and determine eligibility for loans

- Cross-check employer information by confirming the employer listed on the W-2 with other records or through direct contact, such as pay stubs, tax returns, or VOE (verification of employment) forms

- Validate tax compliance, especially for high-value loan applicants

But W-2s are not infallible. Fraudsters can forge them to inflate earnings or create entirely fake employment histories. Some even reuse old W-2s with minor edits, hoping the changes go unnoticed.

That’s why forward-thinking lenders (loan underwriting) don’t just collect W-2s. They analyze them with AI-powered tools like Inscribe. These tools can spot signs of forgery, identify formatting anomalies, and detect inconsistencies between documents in real time.

.webp)

The result? Faster decision-making, fewer losses, and a smarter way to keep fraud out of your portfolio.

How fake W2 and 1099 forms can negatively impact a bank or lender

Fraud happens anywhere. However, banks and other financial institutions are major targets of fraud schemes, which increase in number, volume, and variety.

Different lenders have experienced untold significant losses because of fake documentation and other fraudulent activities, particularly with commercial mortgage loans.

It’s difficult for banks to detect when fraud is happening, increasing the likelihood of making losses. This includes those incurred from paying stiff penalties for neglect. Implementing advanced fraud detection tools and thorough verification processes can help reduce risk for banks and lenders.

How to spot a fake W-2 form

Being able to recognize the common signs of a fake W-2 form is crucial for banks, lenders, and property managers. It's important to identify signs of fraud to prevent financial losses and ensure only legitimate documents are accepted.

Banks and lenders rely on genuine documentation to approve or deny loan or credit applications.

It’s challenging to identify a fake W-2 form with the naked eye. Internet sites, off-the-shelf software, and advanced W-2 generator tools make it relatively easy to create fake W-2 statements.

From a Fraud Investigations symposium organized by the Federal Financial Institutions Examination Council (FFIEC), some of the red flags to look for in a fake W-2 form include:

- Income inconsistency: the borrower’s income doesn’t match their type of employment

- Invalid SSN: differences in the SSNs on the W-2 form and other documents, or it’s been recently issued

- Grammatical errors: misspelled names or numbers that appear to be “squeezed in,” and other glaring grammatical issues.

- Data variances: Employment data varies with other file documentation

- Amounts: rounded numbers for prior year’s earnings or year-to-date are a red flag and often indicate a fake document, as real payroll figures usually have minor variances

- Withholdings: amounts withheld for Medicare, Social Security, and other government programs don’t match the required levels

- Check numbers: No chronological increase in the figures

- Debt disclosures: fake W-2 forms don’t disclose debts like credit union loans, which are reflected as deductions from the employee’s pay

- Commission-type: only shows “base” salary, but legitimate W-2s should reflect all components of salary compensation, including bonuses and tips

- Document alterations: cross-outs or white-outs, inconsistent fonts, W-2 is typed, and paystubs are computer-generated

- Non-computer generated form: W-2 forms from a large employer are usually computer-generated (If not, it’s likely a fake version)

- Strange EIN: fake forms don’t have the XX-XXXXXXX EIN format or it’s not all numeric.

- Names and addresses: inaccurate names and addresses of the employer and employees; always verify the employer's name, address, and identification number

- Income differences: income differs from what’s reported on tax returns, mortgage loan applications, and VOE (verification of employment)

- Excess ceilings/percentages: medicare wages or Medicare taxes, the Federal Insurance Contribution Act (FICA), and other local taxes (where applicable) exceed certain set percentages or ceilings

- Missing Copy C: if the W-2 form isn’t “Employee’s Copy” (Copy C), it’s fake

- Blurry text or spelling errors: blurry text, low-resolution images, and spelling errors are common signs of document tampering and should be treated as a red flag

While these red flags can help identify signs of fraud, the manual review process has limitations. Many sophisticated forgeries can escape detection by the human eye, especially when it comes to subtle inconsistencies or tampering. Automated solutions can analyze formatting, metadata, and other details that are difficult for humans to spot. Property managers also rely on W-2 verification to screen tenants and minimize rental risks, making accurate detection of fake documents essential.

How to spot a fake 1099 form

Just like fake W-2s, 1099 forms can be manipulated to inflate income, fabricate employment, or commit tax and loan fraud. Spotting these fakes is difficult without specialized tools, especially because 1099s come in many variants (1099-MISC, 1099-NEC, 1099-DIV, and more).

Some common red flags that may signal a fake 1099 form include:

- Income that doesn’t align with the applicant’s occupation or credit profile

- Unusual issuer information, such as an unknown payer name or inaccurate EIN

- Round-numbered income that appears unrealistic or too consistent month over month

- Lack of state or federal tax withholdings, when such deductions are normally expected

- Mismatch between the 1099 and other submitted documents, like bank statements or W-2s

- Visual inconsistencies, including differences in font, spacing, or format from IRS-issued examples

When comparing 1099 forms with other documents, it is crucial to request and review supporting documentation—such as bank statements, pay stubs, or previous tax returns—to confirm the authenticity of the reported income and detect discrepancies.

Because 1099s are used to report income outside of traditional employment—like freelance, contract, or investment earnings—they are often targeted by fraudsters looking to invent or exaggerate income streams.

Automated tools like Inscribe can compare a 1099 form’s contents against known fraud patterns and surface discrepancies that manual reviewers might miss.

Don't overlook pay stub verification

While much attention is given to W-2 and 1099 forms, pay stub verification is a critical yet often overlooked part of the income verification process. A pay stub provides a detailed breakdown of an employee’s earnings, deductions, and net pay for a specific period. However, with the rise of online editing software, it has become alarmingly easy for fraudsters to create convincing fake pay stubs.

For lenders and financial institutions, simply accepting a pay stub at face value is no longer sufficient. Automated verification tools can help detect inconsistencies, such as mismatched deductions or formatting errors, that may indicate a fraudulent document.

By thoroughly verifying pay stubs alongside other income documents, organizations can strengthen their fraud prevention efforts and ensure that the income information provided by borrowers is both accurate and legitimate. This extra step in the process can make a significant difference in reducing risk and protecting against financial losses.

Prevent fraud by verifying the validity of a W-2 and 1099 form

Preventing fraud starts with knowing how to verify the legitimacy of income documentation. While it may seem straightforward, W-2 and 1099 forms are surprisingly easy to fabricate. Fraudsters can manipulate PDFs, download editable templates, or use online generators to create fake forms that look convincing at a glance.

Financial institutions must go beyond surface-level checks. The manual review process (such as visually confirming totals or checking employer details) has significant limitations in today’s fraud landscape. Criminals are using more sophisticated techniques, embedding false information into documents that can slip past manual review and increase the risk of errors.

That’s why successful fraud prevention depends on layered verification. This includes:

- Cross-referencing data from multiple sources (e.g., employer records, tax transcripts)

- Confirming SSNs and EINs against verified registries

- Checking for document tampering, inconsistent formatting, or altered metadata

- Taking time to double check all information and documentation for inconsistencies

With modern technology like Inscribe, financial institutions can automatically detect signs of forgery, manipulation, and document reuse, helping to prevent fraud before it escalates.

We urge people involved in the verification process to remain vigilant and proactive in identifying potential fraud.

Best practices for fake income document detection

Detecting fake W-2 forms, pay stubs, and other income documents requires a proactive and multi-layered approach. Financial institutions and lenders should implement the following best practices to reduce the risk of fraud:

- Leverage automated verification tools: Use advanced software to analyze documents for signs of tampering, such as altered metadata or inconsistent formatting, which are often missed by manual reviews.

- Verify employer and income data: Cross-check employer information and reported income with trusted databases and third-party sources to confirm legitimacy.

- Look for red flags and inconsistencies: Be alert to warning signs like rounded income numbers, unusual deductions, or discrepancies between documents.

- Cross-reference with other documents: Compare pay stubs, W-2s, and other forms to ensure consistency across all submitted materials.

- Utilize machine learning software: Employ machine learning to detect subtle patterns and anomalies that may indicate fake documents or sophisticated fraud attempts.

By following these best practices, financial institutions and lenders can more effectively verify income, identify fake W-2s and pay stubs, and protect themselves from the growing threat of document fraud.

How Inscribe helps banks and lenders catch fake W2 and 1099 forms

Financial institutions lose millions each year to fraud schemes involving fake income documents. Whether it’s synthetic identity fraud, unemployment scams, or falsified income to secure loans, fake W2 and 1099 forms are a common tactic. Inscribe was built to stop them.

Unlike manual processes or basic validation checks, Inscribe uses advanced document fraud detection powered by AI agents. These agents don’t just look at the document in isolation—they reason through the data, compare it across sources, and check for document tampering, manipulation patterns, and contextual mismatches. Learn more about AI fraud detection.

Here’s what Inscribe does automatically:

- Cross-checks employer and employee data against third-party databases

- Detects document editing traces like whiteouts, inconsistent fonts, and resaved metadata

- Flags numerical anomalies, like round numbers, invalid EINs, or excessive withholdings

- Verifies document provenance, including device fingerprinting and source reliability

And it’s not just about detection. Inscribe's AI agents explain their findings in plain language—helping your analysts make confident decisions without getting buried in manual work.

Get started with a free trial today and experience how Inscribe stops fraud before it starts.

Fake W-2 and 1099 Form FAQs

What is a fake W-2 or 1099 form?

A fake W-2 or 1099 form is a forged or altered tax document created to misrepresent income or employment details. Fraudsters use them to obtain loans, benefits, or tax refunds fraudulently.

Why do banks and lenders ask for W2s and 1099s?

Lenders use W2s to verify employment and income history, while 1099s help validate other income sources (like freelance work or investments). These forms help determine a borrower's creditworthiness and eligibility for loans.

What are common red flags in fake W2s?

Look for inconsistent income, mismatched SSNs, grammatical errors, strange EINs, altered fonts, or forms that aren’t computer-generated. Round income figures or missing Medicare/FICA deductions can also indicate fraud.

Can fake W2s be detected manually?

While possible, manual review is time-consuming and prone to error. Many fake forms are sophisticated and can pass undetected. That’s why automated solutions like Inscribe are critical for accuracy and scale.

How does Inscribe detect fake W2s and 1099s?

Inscribe uses AI trained on thousands of authentic and fake documents to identify fraud patterns. It checks for signs of manipulation, cross-validates data, and flags anomalies automatically—providing instant decisions with explanations.

Is Inscribe suitable for small and large financial institutions?

Yes. Inscribe scales to meet the needs of fast-growing fintechs, regional lenders, and large banks alike. It integrates seamlessly into existing workflows and delivers results with speed and precision.

How can I try Inscribe?

You can explore Inscribe’s fraud detection capabilities by starting a free trial or requesting a demo. Experience how AI agents instantly verify income documents—without slowing your team down.

About the author

Brianna Valleskey is the Head of Marketing at Inscribe AI. A former journalist and longtime B2B marketing leader, Brianna is the creator and host of Good Question, where she brings together experts at the intersection of fraud, fintech, and AI. She’s passionate about making technical topics accessible and inspiring the next generation of risk leaders, and was named 2022 Experimental Marketer of the Year and one of the 2023 Top 50 Woman in Content. Prior to Inscribe, she served in marketing and leadership roles at Sendoso, Benzinga, and LevelEleven.

Learn More

Dive deeper into document processing

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.