Understanding Proof of Address: How to Detect & Prevent Address Document Fraud

Learn how to verify address documents and detect fake proof of address files using AI. Discover how Inscribe improves address verification, prevents fraud, and accelerates onboarding.

Table of Contents

[ show ]- Loading table of contents...

Brianna Valleskey

Verifying a customer’s address is an important part of doing business for many organizations. It can confirm the person’s identity, establish their eligibility as a patron, and ensure the ability to communicate in the future. For banks and financial institutions, these checks are also a matter of law, meaning that regulations require them to confirm the locality of the customer before onboarding them. An official document issued by a recognized authority, such as a government agency or bank, proves the customer's address and serves as valid proof for compliance purposes.

Confirming a customer’s address is also an important step in catching and preventing fraud. Since it is not uncommon for cybercriminals to use an address other than their own to carry out their schemes, many cases of financial fraud involve a manipulated or forged proof of address document. Organizations that identify document fraud in this form may be able to outright prevent a case of fraud and avoid the often devastating costs associated with it.

What is proof of address?

Proof of address is the act of verifying where a person or business physically resides. This is typically done by reviewing an approved proof of address document and cross-referencing it with both identification or ownership documents and an address database. Identity verification often involves checking both an ID document, such as a government issued ID, and a proof of address document to establish a person's identity and residence. The process may require a cross check between different document types to ensure consistency and authenticity.

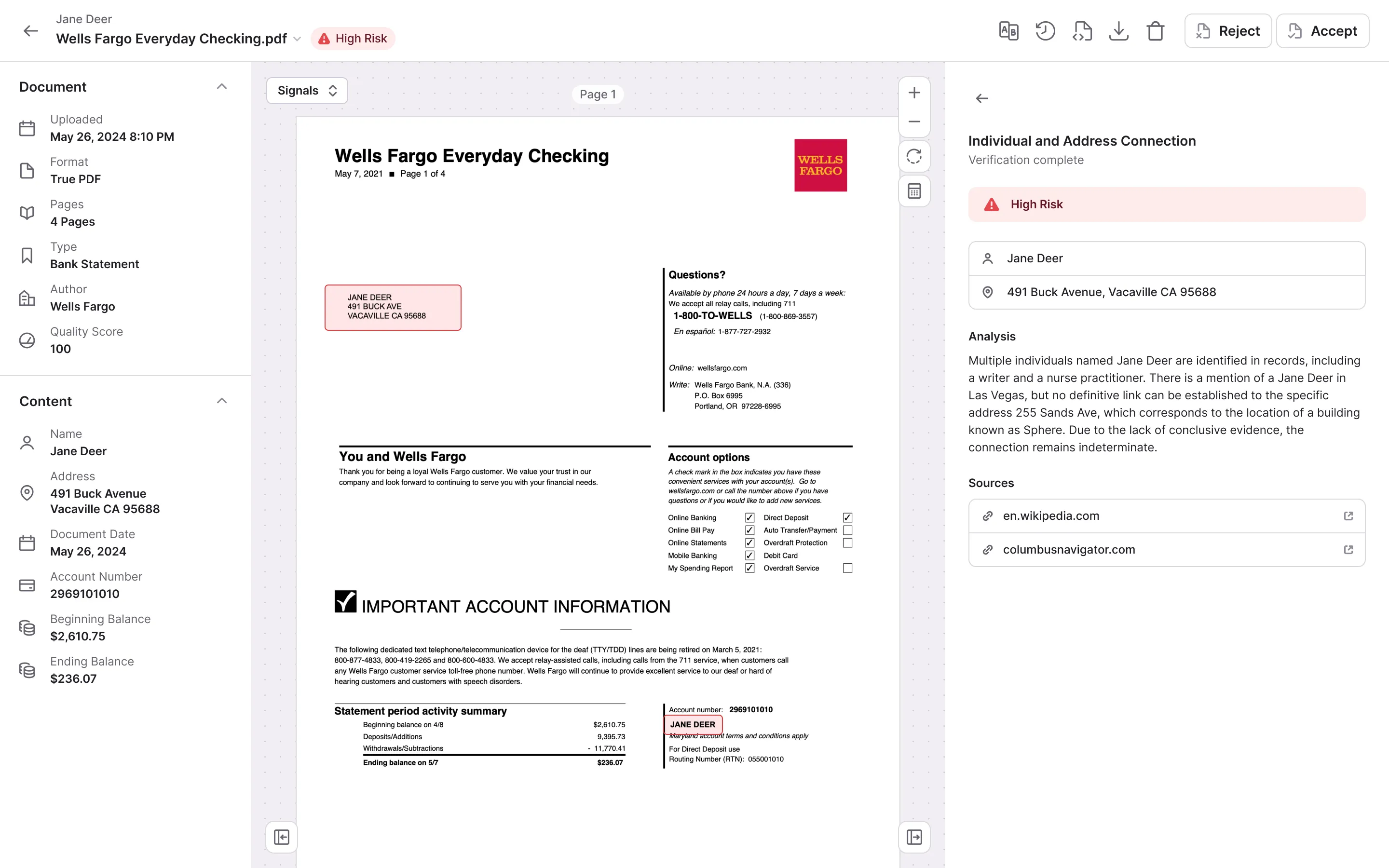

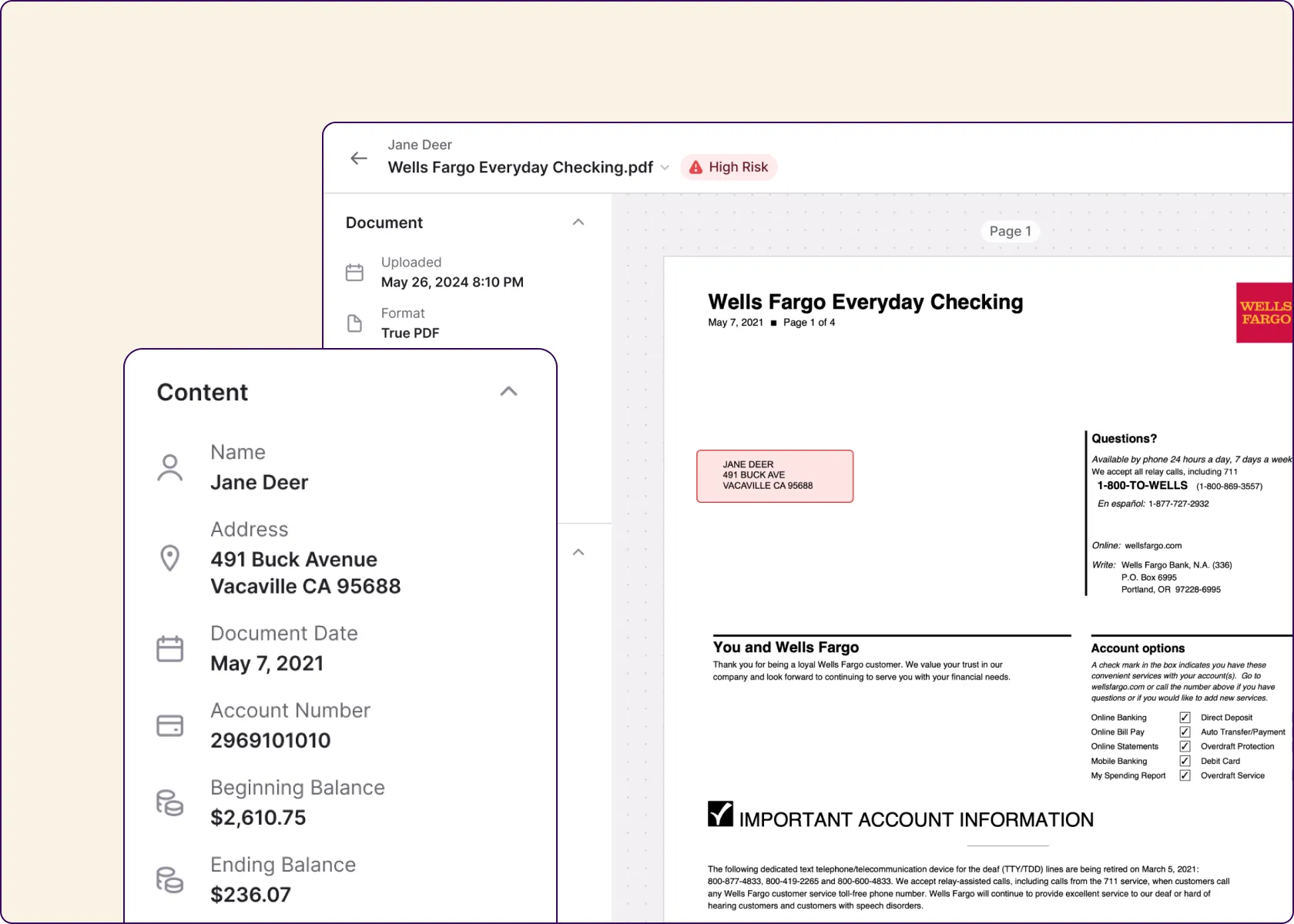

How Inscribe helps with address verification

Verifying address documents is critical, but time-consuming. Inscribe uses AI to instantly detect fake proof of address documents, helping companies verify customers faster, comply with regulations, and reduce fraud.

Take an interactive product tour to see how Inscribe streamlines proof of address checks and automates document fraud detection.

What are proof of address documents?

Various documents can be used to establish proof of address. While the requirements will vary from organization to organization, the documents count and document type accepted as proof of address may differ depending on the specific policies of each organization. The most commonly accepted forms of documentation are lease agreements or residence permits, as well as utility bills.

Generally accepted proof of address documents are listed below.

- Utility bills (water, electricity, gas, telephone, mobile phone or internet)

- Bank statements or documents related to a bank account

- Bank reference letter

- Lease agreement or mortgage statement or contract

- Pay stub

- Insurance documents or insurance policy (commonly accepted as official documentation for proof of address)

- Car registration

- Change of address letter

- Letter of employment

- Letter from a government agency or public authority (such as a tax authority or police department)

- Driver’s license (a widely accepted form of official documentation for proof of address)

- Residence permit

- Letter from a family member, when notarized or accompanied by supporting official documentation, may be accepted in some cases

To establish someone’s residence, the proof of address (poa) documents must meet several requirements, including …

- Current: The document should have been issued in the past three months to ensure the address is current and reflects the applicant's current residential address and current address.

- Original: The document must be an original version or an official copy.

- Official: The document must be issued by a recognized third-party organization, such as a utility provider or government agency. The organization’s name must be clearly visible and contain their direct contact information.

- Recent and Recognized: PoA documents must be recent and issued by a recognized authority.

Again, it is important to remember that proof of address requirements will vary from organization to organization. There may be specific requirements based on the company’s industry or location. It is the responsibility of the individual to review proof of address requirements for their situation and prepare their documentation accordingly.

The significance of verifying addresses

There are many reasons why a company or organization may need or want to verify an application’s or customer’s address. Proof of address is a mandatory requirement across many industries as part of due diligence and compliance checks.

These may include:

- Complying with regulations, such as Know Your Customer (KYC) and Anti Money Laundering (AML), that require the organization to verify the person’s personal information, including their name, date of birth, government ID number, and user's address, as part of ongoing due diligence.

- Reducing the risk of fraud by confirming the individual’s identity and personal details.

- Proving residency and providing evidence, such as utility bills or bank statements, that prove the user's address to meet regulatory requirements.

- Establishing a line of regular communication.

- Ensuring eligibility as a customer or service recipient based on geography, jurisdiction, or other details set out in a licensing agreement.

Traditional methods of address verification

Traditionally, the address verification process was largely manual. Would-be customers would scan and submit copies of documents that were then reviewed by a human analyst to confirm they matched other documentation and showed no obvious signs of tampering. This person would also search for the address in a database or via a search engine to ensure it existed. Manual checks are prone to human error and can compromise data accuracy, making it difficult to maintain precise and correct address information.

This process can be time-consuming, error-prone, and resource-intensive, especially if the document collection process is in poor condition. This leads to longer wait times for customers and higher costs for businesses as companies must follow up with the customer and request additional documentation or ask them to re-scan files.

In addition, relying on human reviews is often not an effective way to identify fraudulent documents, as many alterations and manipulations are invisible to the naked eye, and forged documents can be indistinguishable from real files. These reviews can also be subjective and variable, in that they rely on one person’s experience and expertise to approve or deny a customer—potentially introducing bias into the customer experience.

Finally, many companies that complete proof of address checks manually must also develop processes for saving and storing these materials for future reference. For many organizations, there are specific security requirements that must be adhered to when storing sensitive personal information or documents like bank statements. It is crucial to implement procedures that ensure accuracy when handling such sensitive documents to maintain data accuracy and prevent fraud.

The challenge of address fraud

Fraud is a real concern for organizations of all kinds. And in the digital age, the risk is greater than ever. In fact, data from Inscribe shows that 10% of all financial application documents submitted in an online channel have been manipulated.

While a customer’s proof of address document may seem insignificant, it holds incredible value for detecting fraud. When viewed within the context of the total customer profile, it can provide valuable clues that may alert reviewers to a case of potential fraud.

For example, if a person’s proof of address documentation does not match their identification documents, that could be a potential red flag that the person is not who they are purporting to be. If addresses are not consistent across a proof of address file and a pay stub or bank statement, that may be a sign that one or more documents is fraudulent or has been tampered with. These inconsistencies are red flags that forensic analysis or verification processes can uncover to identify potential fraud.

Organizations should recognize the role that proof of address documents play in detecting and preventing fraud and take steps to improve their ability to identify documents that have been altered or forged. Accurate address data collection and verification are essential for detecting and preventing fraud, as reliable address data helps ensure document authenticity and compliance.

AI-powered fraud detection in address verification

To combat the rise in document fraud of all kinds, organizations should leverage AI-enabled document review tools to more quickly and accurately identify fraudulent documents. These solutions use algorithms that analyze millions of data points to check every aspect of a submitted document, including the metadata, pixel-level information, and file history, comparing submitted files against known authentic statements to determine discrepancies invisible to the naked eye. Documents are also verified against authoritative databases to ensure authenticity and legitimacy.

Here’s what you can achieve with AI-driven, automated scrutiny of documents:

- Swift operationality: Our analysis underscores that an exhaustive manual examination of an individual document could span 5-10 minutes, impeding the decision-making process and prolonging the coordination lifecycle with potential borrowers by several business days. By leveraging a document automation tool like Inscribe, you can receive a comprehensive analysis of file metadata, pixel-level details, and file history in a mere 10 seconds. This empowers human reviewers to significantly amplify their processing speed when handling applications.

- Precision augmentation: A staggering 90% of document fraud eludes human detection, making alterations to identity or financial details nearly imperceptible. Nonetheless, Inscribe employs state-of-the-art AI and machine learning technology to render invisible fraud signals visible. The X-Ray feature exposes both the uploaded and recovered versions of a document, enabling reviewers to discern precisely what changes have been made, including names, amounts, dates, balances, and other critical details.

- Bias mitigation: Automated review tools, exemplified by Inscribe, function with objectivity, appraising documents based on face value and ensuring uniform scrutiny of all applicants using identical criteria and standards. This contributes to the reduction of unintentional bias throughout the entire customer onboarding process.

- Accumulative benefits: AI-powered tools possess a learning capability, refining their precision and accuracy over time as the model encounters an expanding array of examples. This evolutionary trait is pivotal, especially considering that criminals consistently devise novel methods to produce fraudulent documents

Integrating an AI-powered fraud detection tool into an organization’s existing tech stack requires careful consideration of the other software and systems in use. A reputable vendor will help their customers determine if these systems are compatible and offer support to configure and integrate these solutions, as well as incorporate them within existing workflows. This is a critical point for ensuring compliance with regulatory requirements and maintaining data accuracy throughout the process, so that all documents and addresses are properly verified.

Regulatory compliance in address verification

Regulatory compliance is at the heart of address verification for businesses, especially those in the financial sector. Adhering to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is not just best practice; it’s a legal requirement for financial institutions and many other organizations. These regulations mandate that businesses verify proof of address using accepted documents such as utility bills, bank statements, and government-issued IDs. By ensuring that only valid and properly formatted documents are accepted, companies can confidently verify customer addresses and meet compliance standards.

Implementing robust fraud detection measures is equally crucial. Compliance checks must go beyond simply collecting documents; they require thorough verification to detect forged or manipulated files. Address verification software streamlines this process, automating the review of address documents and reducing the risk of human error. This not only helps businesses stay compliant with AML regulations but also protects against identity theft and other forms of fraud. By leveraging technology, businesses can efficiently verify proof of address, maintain compliance, and safeguard their operations.

International address verification challenges and solutions

Verifying addresses on a global scale introduces a unique set of challenges. Address formats, document types, and verification requirements can differ significantly from one country to another, making it difficult for businesses to maintain consistency and accuracy. Manual processes are prone to human error, especially when dealing with unfamiliar address structures or foreign languages.

To overcome these obstacles, businesses are turning to address verification software that supports a wide range of document types and languages. This approach not only ensures compliance with international AML regulations but also enhances fraud prevention efforts and delivers a seamless customer experience, no matter where the user is located.

Data extraction and normalization in address verification

Accurate address verification relies on effective data extraction and normalization. Modern address verification software can automatically extract key information from documents such as utility bills and bank statements, including the user’s name, address details, and date of issue. This data is then normalized (standardized and formatted consistently) so it can be reliably compared against trusted sources like government agencies and financial institutions.

By verifying address details through this process, businesses can provide proof of address with greater confidence and ensure the authenticity of submitted documents. Data extraction and normalization not only improve the accuracy of address verification but also help meet regulatory requirements and reduce the risk of fraud. With automated verification, businesses can minimize manual errors, streamline compliance processes, and protect against identity theft, all while delivering a faster and more reliable experience for their customers.

Automating Proof of Address checks with Inscribe

Manual address verification is no longer enough. Fraudsters are getting more sophisticated, often forging documents that look completely authentic. Traditional reviews are slow and error-prone, and human reviewers can miss critical fraud signals that are only visible through deeper digital analysis. That’s where Inscribe comes in.

Our AI-powered fraud detection solution analyzes address documents with unmatched precision. It reviews metadata, pixel-level patterns, and tampering history—far beyond what the human eye can detect. With Inscribe, organizations can:

- Identify fake address documents in seconds

- Reduce operational costs by eliminating manual reviews

- Comply with KYC and AML requirements without delays

- Onboard legitimate customers faster and with confidence

- Prevent identity fraud before it causes downstream harm

Whether you're processing utility bills, bank statements, or lease agreements, Inscribe provides a scalable, accurate, and secure way to verify address or income documents in real time. It integrates seamlessly with your existing systems and workflows to deliver fast, reliable results that grow with your business.

Ready to see it in action? Start your free trial today and watch Inscribe detect fake proof of address documents instantly, before they become a problem.

Frequently Asked Questions About Proof of Address

How recent must a proof of address document be?

Most companies require a document issued within the last 3 months to ensure it’s current and tied to the applicant’s actual residence.

What types of documents qualify as proof of address?

Commonly accepted address documents include utility bills, bank statements, mortgage or lease agreements, insurance policies, pay stubs, government letters, and driver’s licenses. In some cases, identity documents such as passports or national IDs may also be required alongside proof of address.

Can fake proof of address documents be detected with AI?

Yes. AI-powered fraud detection tools like Inscribe can detect tampering, metadata manipulation, and inconsistencies in address documents that human reviewers typically miss.

Why is verifying a customer’s address important?

Address verification ensures compliance (e.g., KYC/AML), reduces fraud risk, supports communication, and validates eligibility based on geographic requirements.

Is it legal to submit a false proof of address?

No. Submitting fake address documents is considered fraud and can result in legal consequences including fines or criminal charges.

Can digital documents be used as proof of address?

Absolutely. Digital submissions are widely accepted, especially during online onboarding. However, verifying their authenticity is crucial to prevent fraud.

How does Inscribe help with address verification specifically?

Inscribe verifies address documents using AI by instantly analyzing visual and hidden file elements. It flags anomalies, compares files for consistency, and confirms authenticity across all document types.

How can I integrate Inscribe into my existing system?

Inscribe integrates with most modern tech stacks and offers full support during onboarding and implementation to ensure a seamless setup.

Are there regulations for using AI in document verification?

Yes. Compliance varies by industry and region. Inscribe supports these requirements by offering secure, explainable, and regulation-ready fraud detection.

About the author

Brianna Valleskey is the Head of Marketing at Inscribe AI. A former journalist and longtime B2B marketing leader, Brianna is the creator and host of Good Question, where she brings together experts at the intersection of fraud, fintech, and AI. She’s passionate about making technical topics accessible and inspiring the next generation of risk leaders, and was named 2022 Experimental Marketer of the Year and one of the 2023 Top 50 Woman in Content. Prior to Inscribe, she served in marketing and leadership roles at Sendoso, Benzinga, and LevelEleven.

Learn More

Dive deeper into document processing

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.