How to Detect a Fake Pay Stub: Essential Tips for Verification

Learn essential tips to spot a fake pay stub and ensure financial security. Read the article for practical verification methods you can trust.

Table of Contents

[ show ]- Loading table of contents...

Brianna Valleskey

Are you seeking to uncover whether a pay stub is the real deal or a sham? This article cuts to the chase on how to detect a fake pay stub. Prepare to gain insight into the red flags that can signal a fraudulent document, from odd number crunching to inconsistent design details, equipping you with the know-how to protect your financial interests.

Key takeaways for how to detect a fake pay stub

- Careful scrutiny of physical attributes such as alignment, font consistency, and professional presentation of a pay stub can reveal signs of forgery, with details like proper formatting and the differentiation between similar characters being key indicators of authenticity.

- Dissecting the numerical data, including gross pay, net pay, and deductions, on a pay stub is essential; inconsistencies or incorrect calculations can indicate a fake document, necessitating a thorough understanding of tax laws and typical deductions.

- Verification of fundamental personal and employment-specific information is vital; inconsistencies or missing details such as employee names, employer addresses, and pay periods are red flags, and cross-referencing with other sources like tax documents and bank statements can bolster authenticity checks.

How how Inscribe helps detect fake pay stubs and other fraudulent documents

Before diving into the manual red flags, see how Inscribe makes detecting fake pay stubs faster, easier, and more accurate. Our AI platform automates the tedious parts of document verification so your team can focus on what matters most: making confident decisions.

Here’s how Inscribe helps you catch fakes:

- Detects Formatting and Presentation Issues with AI: Inconsistent fonts, misaligned numbers, or blurry text are telltale signs of fraud. Inscribe automatically flags these signs by scanning for unusual formatting, mismatched characters (like 0 vs. O), and inconsistent layouts—down to the pixel.

- Verifies Calculations in Real Time: Fake pay stubs often include incorrect gross-to-net calculations or perfectly rounded numbers. Inscribe checks that the math adds up, including year-to-date totals, tax deductions, and paycheck consistency. If something seems illogical, we highlight it instantly.

- Cross-Checks Employer Info with Public Records and the Web: A missing or fake employer name/address is a major red flag. Inscribe automatically verifies employer legitimacy through web search and Secretary of State databases. If the employer doesn’t exist or looks suspicious, it’s flagged (no extra research required).

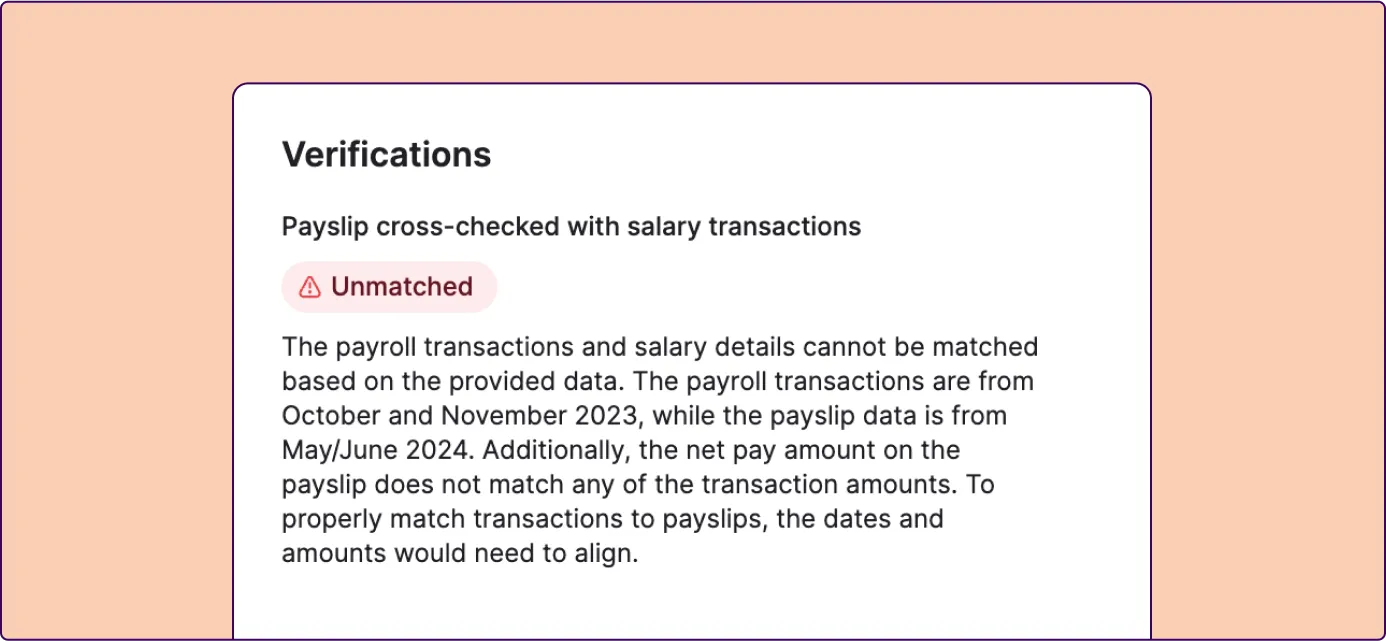

- Cross-Validates Across Documents: As suggested in your article, comparing pay stubs with other documents like bank statements and W-2s is crucial. Inscribe makes that easy by extracting and comparing data across multiple uploaded files to surface inconsistencies in pay periods, income, or identity details.

- Flags Metadata Tampering and Template Fraud: Many fake pay stubs are created using online generators or reused templates. Inscribe analyzes document metadata and structure to detect recycled templates or signs that a document was altered post-generation—something manual reviewers can easily miss.

- Provides Evidence You Can Act On: Instead of just saying “this looks off,” Inscribe shows you why—offering highlighted discrepancies, confidence scores, and annotated screenshots. That means faster decisions and better protection for your business.

Key indicators of fake pay stubs

Spotting a fake pay stub starts with a meticulous review of its physical attributes. The devil, as they say, is in the details. While counterfeiters may go to great lengths to reproduce the look of genuine pay stubs, the reality is that faking the sophistication of professional accounting methods is no easy feat. Accountants create pay stubs using accounting software, which ensures accuracy and consistency in formatting and professional appearance. Hence, the first line of defense in identifying fake pay stubs is to examine their alignment, font consistency, and overall professional presentation.

Legible text, proper formatting, and consistent alignment are key identifiers of an authentic pay stub. Real pay stubs demonstrate a level of professionalism through their presentation and structure, indicating the use of professional accounting methods. Accounting software automatically aligns digits, decimal points, and formatting elements, making authentic pay stubs more consistent and reducing errors.

A suspicious pay stub may exhibit inconsistencies such as text that doesn’t line up correctly or has varying font styles and sizes. When reviewing the applicant's pay stub, closely examine its formatting and clarity. Legitimate documents will be neat, free of typos, and have properly aligned numbers and text, which are strong indicators of authenticity. Even the distinction between the number ‘0’ and the capital letter ‘O’ should be clear and consistent throughout the pay stub, as their size and shape differ, to avoid suspicions of forgery.

Keep in mind, observing specific details like font and alignment can significantly aid in differentiating a genuine pay stub from a counterfeit one. Many pay stub generators are available online, making it easier for individuals to create fake pay stubs that mimic professional formatting.

Alignment and font consistency

In the realm of pay stubs, alignment is an indicator of authenticity. Automated accounting systems, which are typically used by accountants to create pay stubs, are designed to align digits and decimal points consistently. If you come across a pay stub where the figures seem haphazardly placed or the decimal points are not uniformly lined up, it’s time to raise an eyebrow. Genuine pay stubs should have precise alignment, and any alignment issues can be a sign of a non-authentic document.

The choice of font is just as important as alignment. Professional pay stubs avoid eclectic fonts, instead opting for standard, professional typefaces. If a pay stub exhibits a poor-quality presentation, such as blurriness, pixelation, or irregular fonts, it could be a clear indication of a fake document. Keep in mind, a genuine pay stub involves more than just numbers; it also demands a professional and completely legible presentation.

Professional presentation

A professional document’s value is not only in its content but also its presentation. A polished look is crucial for official documents, as a lack of professionalism can signal the presence of fake pay stubs. Therefore, when assessing a pay stub, it’s important to gauge its overall professional presentation. Authentic pay stubs exhibit a polished, professional look, reinforcing transparency and trust.

The professional authenticity of a pay stub is indicated by the absence of blurry text, use of professional fonts, and consistent alignment throughout the document. Pay stubs, when professionally presented, reinforce transparency about employee earnings and deductions and play a key role in fostering trust and enabling accurate financial planning for employees. Thus, when analyzing a pay stub next time, bear in mind that its professional presentation can reveal a lot about its genuineness.

Dissecting the numbers: Gross Pay and Calculations

After scrutinizing the physical attributes of pay stubs, we should now probe further into the numerical aspects. A quick glance at a pay stub reveals a wealth of financial information, including:

- Gross pay (also referred to as gross earnings)

- Net pay

- Deductions

- Taxes

Analyzing these numbers is a crucial step in identifying fake pay stubs. A legitimate pay stub should detail taxes, insurance deductions, and gross pay. Their absence could suggest fraudulent activity.

Discrepancies in net pay, pay periods, gross pay, or employment dates on a pay stub should prompt suspicion as this can indicate that the document originated from a fake pay stub generator. Pay stubs that show extra dollars or perfectly rounded numbers (such as whole dollar amounts without cents) can also be a sign of a fake, since real paychecks typically include cents and rarely have all amounts rounded.

Employers need to verify that the sum of the numbers provided on the pay stub is consistent with the applicant's income to assess their ability to pay the monthly rent and to detect fraudulent income claims. It is important to confirm the applicant’s income by reviewing the applicant’s pay stub and supporting documentation, such as W-2 forms or employment reference letters. Confirming the applicant's income is essential to ensure they can meet their monthly rent obligations. The authenticity of a pay stub can be established by ensuring that all earnings and deductions are correctly calculated and that there are no illogical figures or miscalculations.

Analyzing gross pay and net pay

Gross pay and net pay are the heart of a pay stub. Gross pay refers to the total income earned by the employee before any deductions, while net pay is what remains after all deductions are made. Analyzing these figures can provide valuable insight into the authenticity of a pay stub.

To determine if gross pay and net pay amounts are reasonable, it’s necessary to have a clear understanding of the tax laws and typical deductions such as:

- FICA

- Medicare

- Insurance premiums

- Contributions to retirement plans

By confirming that the gross pay on a pay stub aligns with the hours worked multiplied by the hourly rate, or matches the agreed salary, one can identify inconsistencies that suggest a fake pay stub.

Net pay should be accurately calculated by subtracting all applicable deductions, including taxes and other withholdings, from the gross pay; discrepancies here could indicate a manipulated or fake pay stub. So, the next time you’re handed a pay stub, remember to do the math—it could reveal the truth behind the numbers and help you identify a real pay stub.

The math behind detecting a fake pay stub

Now that we’ve understood the importance of gross pay and net pay, it’s time to delve into the detailed calculations that form the basis of these figures. To ensure accuracy on a pay stub, verify that all deductions from the listed gross pay, such as federal and state taxes, insurance premiums, and contributions to other programs, correctly calculate to the net pay. Gross wages on a pay stub should correspond with an employee’s expected annual salary divided by the number of pay periods, or the total hours worked multiplied by their hourly wage.

A telltale sign of a fraudulent pay stub is when the year-to-date gross income is inaccurately lower than the year-to-date net pay, indicating incorrect mathematical calculations. It’s essential to remember that while the presentation of a pay stub plays a crucial role in its authenticity, the math behind it is equally important. A single miscalculation or inconsistency can be the key to spotting a fake pay stub.

Authenticity in the details: Basic Information Scrutiny

After analyzing the numerical aspects, we should now focus on the fundamental information present on a pay stub. This includes personal details like the employee’s name and address, as well as employment-specific information such as the company’s name and pay periods. A pay stub missing key personal or company details, such as names and addresses, may indicate a forged document.

Genuine pay stubs should always include the applicant’s name, address, company name and address, along with tax and insurance deduction details, and this key information should appear in multiple places on the document for easier cross-checking and to help spot inconsistencies.

Inconsistencies in the basic information of a pay stub can be a major red flag for its authenticity. While the appearance of pay stubs can vary between employers, the inclusion of certain basic information remains a common requirement. So, as you examine a pay stub, remember to scrutinize each piece of information, no matter how basic it might seem. To further verify authenticity, compare the pay stub with other official documents, such as bank statements or tax forms, to ensure the details match across all sources. A tax form, such as the W-2, is a crucial document used by employers to report employee wages and verify income for employees, and it differs from forms like the 1099, which are used for self-employed individuals.

Personal data accuracy

Personal data is arguably the most essential information on a pay stub. After all, it’s this information that links the pay stub to an individual. Ensuring pay stubs have complete and accurate general information, such as employer and employee details, is crucial for legal compliance and record-keeping. These details are also a critical component of the application process, especially for lenders and property managers verifying income.

Missing or inconsistent information, such as varying addresses or social security numbers on the pay stub, can signal a fraudulent document and are considered red flags. Correct Social Security numbers are key to successful processing of annual wage report submissions, making their verification an essential component of assessing pay stub accuracy. Thus, when you verify a pay stub next time, make sure to focus closely on the personal data; it could be your clue to spotting a forgery.

Employment-specifics verification

Having scrutinized the personal data, it’s now time to focus on the employment-specific information. This includes:

- The employer’s name

- The employer’s address

- The employer’s contact details

- The pay periods

Pay stubs that lack crucial employer details such as a full company address, name, and contact details may be fake. The company’s name and address should be clearly stated in the top section of a genuine pay stub.

Inconsistencies in pay periods and employment durations indicated on a pay stub can be a sign of falsification. Verifying the specific time frame for which the employee is being paid against the employer’s known payroll schedule is essential to confirm a pay stub’s authenticity. Hence, thorough verification of employment specifics is crucial not just for income verification but also to verify the authenticity of a pay stub.

Alternative Pay Stub Verification Methods

Though pay stubs are a rich source of information, it’s prudent to cross-check with other sources. This is where alternative verification methods come into play. Bank statements and tax documents, for instance, can provide additional proof of income and help confirm the authenticity of the information provided on the pay stub. Cross-referencing pay stubs with tax documents, such as W-2 forms or 1099 tax forms, and reviewing tax returns, provides a secondary method to verify annual income reported by the applicant and is especially important when screening tenants for a rental property.

Employment verification, such as confirming the place of work and researching the company, is an alternative approach to ensure that the income stated on the pay stub is credible. It is also important to verify paystubs directly with employers to detect any fraudulent documents, particularly in the context of rental property tenant screening. Bank statements are a reliable source to verify income as they show consistent deposits and can confirm if the tenant’s deposits align with their stated income. So, even though a pay stub is an essential document, bear in mind it’s not the sole source of truth; looking beyond the stub is equally important.

Tax document cross-reference

Tax documents, such as W-2 forms, can provide valuable insights during income verification. The cross-referencing process involves comparing declared values on pay stubs with those reported on tax documents to identify discrepancies or fraudulent activity, which enhances the income verification process. Lenders and employers may ensure consistency by comparing income reported on the most recent W-2 form with the pay stubs provided, also checking the company’s legitimacy through direct verification with the employer’s HR department.

The Social Security Number Verification Service (SSNVS) allows the confirmation of employee names and Social Security numbers matching the Social Security Administration’s records, preventing processing errors. Accurate employment verification necessitates that the information on the pay stub, such as company information and pay period details, aligns with the employee’s W-4 form. To detect a fake W-2, potential discrepancies such as inconsistencies in gross income, blurry presentation elements, and mismatched addresses should be scrutinized, and legitimacy can be verified by researching the reputed company issuing the W-2.

Bank statements review

Bank statements, with their detailed record of deposits, withdrawals, and transactions, provide a clear picture of an individual’s financial health. Reviewing bank statements allows lenders to certify that employees or debtors receive stable income through regular deposits in their account. Banks require monthly bank statements to verify the consistency of income deposits with the income information provided on pay stubs.

By examining bank statements, lenders can:

- Confirm the legitimacy of the employer listed on the pay stub, as the company name should be visible on the deposit

- Obtain a comprehensive view of a borrower’s income, spending habits, and debt repayment history

- Ease the cognitive burden on applicants by providing a clear and straightforward way to show proof of income

Reviewing bank statements is an important step in the loan application process.

Therefore, as a part of income verification, bank statements can act as a powerful tool to corroborate the information shown on pay stubs.

Red Flags & Common Pitfalls

Detecting fake pay stubs involves navigating through numerous red flags and common pitfalls. By being aware of these, you can significantly improve your chances of detecting forged documents. Some common red flags to look out for include:

- Rounded figures or estimations, such as income amounts that are perfectly rounded to the nearest hundred or thousand

- Common errors on fake pay stubs, such as incorrect employee details or poor representation of pay rates

- Omissions in personal detail sections

Fake paystubs, fake stubs, fake utility bills, and fake ones are often created by online companies and can be used by a prospective tenant to deceive a property manager during the rental application process.

Being vigilant and paying attention to these indicators can help you spot fake pay stubs and avoid pay stub fraud by those who create fake pay stubs. If a fake paystub is discovered, it is important to understand what action a fake pay stub takes—such as reporting it to authorities or using it as evidence in legal or eviction proceedings.

When payment formats appear strange or significantly deviate from the common paycheck stub format, it implicates potential fraudulence. It’s crucial to remember that not everyone providing a fake pay stub is trying to commit fraud—some might simply be unaware of the legal implications. Nonetheless, staying alert and understanding these red flags and pitfalls can significantly help you protect your transactions. Potential tenants, a potential tenant, and property managers should all be aware of these risks and take steps to verify the authenticity of pay stubs during the screening process.

Rounded figures and estimations

At first glance, an income amount rounded to the nearest hundred or thousand might not seem unusual. However, when it comes to pay stubs, such rounded figures can be a major red flag. Real pay stubs typically do not have perfectly round numbers, especially after taxes, so round numbers can be a red flag for a false pay stub. Scammers often use round numbers on fake pay stubs, which is suspicious because real paychecks are rarely rounded after deductions.

When the monthly earnings on a pay stub are perfectly rounded to the nearest hundred or thousand, it is a clear indication of a fake pay stub, as genuine paychecks are rarely rounded numbers due to deductions. Pay stubs with perfectly round numbers, especially after taxes and deductions, should be closely scrutinized as they are a common sign of forgery.

Hence, if you come across a perfectly rounded number on a pay stub next time, approach it with ample skepticism.

Generic information and inconsistencies

Generic information or glaring inconsistencies can also indicate a fraudulent pay stub. Here are some signs to look out for:

- Missing company logo or generic company name

- Spelling mistakes and incorrect personal details

- Use of letters in place of numbers

- Inconsistencies in figures, especially in year-to-date totals that do not align or add up properly

These are major red flags for fake pay stubs, fake paycheck stubs, and fake stub, often created by fake pay stub generators. Similar tactics are also used to create fake 1099 forms, posing additional risks of financial fraud.

Genuine pay stubs usually include a company logo, address, and contact information, and consistently missing these details suggests a pay stub might be fake. Therefore, it’s important to scrutinize not just the numbers, but also the basic and company-specific information on the pay stub. Keep in mind, even a single inconsistency can be a strong indicator of a counterfeit pay stub.

Preventative Measures for Banks, Lenders, and Property Managers

Banks, lenders, and property managers regularly need to verify income to ensure smooth transactions. To ensure tenants can pay the rent each month, landlords must verify the income of their prospective tenants. Lenders and property managers should confirm that the company listed as an applicant’s employer exists and check the pay stub for signs of manipulation. As part of the screening process, it is also important to check a tenant's criminal history to ensure there are no past offenses that could pose a risk to the property or other tenants.

Always independently look up an employer’s contact information to validate an applicant’s employment status, rather than using possibly falsified information provided on the pay stub. For applicants who are self-employed, request invoices sent to clients, 1099 tax forms, or an offer letter which includes job description, pay rate, and official start date to authenticate income claims.

Due diligence in screening

In the world of real estate and lending, due diligence is paramount. A thorough screening process can save you from potential pitfalls and ensure that the applicant’s income information is accurate. Rental applications should be comprehensive and include documentation of income, rental history, and references. Lenders and property managers should verify an applicant’s employment status by checking all documentation for signs of alterations and requesting a letter from an employer reference.

Confirming an applicant’s rental history and character through contacting current or past landlords and personal references listed on the application is essential. Landlords must have specific, consistent criteria for accepting or rejecting applicants and document these decisions in detail to avoid allegations of discrimination. Hence, a comprehensive screening process is not just good business but also a vital step in averting fraud.

Incorporating technology solutions

In the current digital era, technology can be a potent ally in your pursuit to authenticate income and identify fake pay stubs. Advanced AI and Machine Learning algorithms are capable of analyzing pay stub data to identify inconsistencies in personal details. Property management software incorporates tools such as automated tenant screening and income verification processes, which streamline rental applications and enhance accuracy.

In the current digital era, technology can be a potent ally in your pursuit to authenticate income and identify fake pay stubs. Advanced AI and Machine Learning algorithms are capable of analyzing pay stub data to identify inconsistencies in personal details. Property management software incorporates tools such as automated tenant screening and income verification processes, which streamline rental applications and enhance accuracy.

Optical Character Recognition (OCR) and Intelligent Document Processing (IDP) tools like Inscribe can be employed to convert pay stub details into machine-readable text and verify personal information against external databases, boosting the accuracy of document analysis.

How to verify paystubs with Inscribe

Inscribe’s platform leverages AI-powered fraud detection algorithms to scrutinize the legitimacy of submitted documents, including pay stubs, by checking for common signs of forgery such as inconsistent fonts, misaligned text, incorrect calculations, and suspicious formatting. It also cross-references data points like employer information, pay periods, and income figures against trusted data sources to detect discrepancies that may indicate fake documents.

Moreover, Inscribe’s technology can automate the extraction and validation of key income details, reducing human error and speeding up the verification process. Bank statements submitted alongside pay stubs can be transformed by automation software into analyzable data formats like JSON or Excel, while AI and machine learning enhance the precision and speed of income verification for financial decision-making. By integrating these cutting-edge tools, property managers and lenders can prevent fraud more effectively, ensuring only genuine pay stubs are accepted during tenant screening.

As such, leveraging technology solutions like Inscribe can significantly ease the process of income verification and detection of fake pay stubs, providing greater confidence and security in financial transactions.

Start accurately, efficiently detecting fake pay stubs today

The journey to detect fake pay stubs is indeed a meticulous one, requiring a keen eye for detail, a knack for numbers, and an understanding of the professional presentation. From the alignment, font consistency, and professional presentation to the gross pay, net pay, and detailed calculations—every element of a pay stub tells a story. And, while the pay stub provides a wealth of information, remember to look beyond it and cross-verify with other sources such as tax documents and bank statements.

Ready to take the guesswork out of document verification? Whether you're a lender, property manager, or risk analyst, spotting a fake pay stub can be time-consuming and error-prone. Inscribe's AI-powered platform automates this process: analyzing formatting, math, and metadata to catch fraudulent documents before they become a liability. If you're looking for a faster, smarter way to verify income documents and reduce risk, reach out to our sales team today to see Inscribe in action.

Frequently Asked Questions

Is there a way to verify pay stubs?

Yes, you can verify pay stubs by cross-checking the information with a bank statement to confirm the income deposit from the company. This will help confirm the validity of the pay stub. You can also use automated document verification tools like Inscribe.

What are the red flags on pay stubs?

Inconsistent pay dates and missing check numbers are red flags to look out for on your pay stub. Also, watch out for misspelled personal information and no tax withholdings. Always review your pay stub for any discrepancies.

What does a fake ADP check look like?

A fake ADP check may have incorrect or incomplete routing numbers at the bottom. You can verify the routing number with the Federal Reserve Department to confirm its authenticity.

How can I verify the personal and employment information on a pay stub?

To verify personal and employment information on a pay stub, ensure that the personal details like Social Security numbers are complete and accurate, and double-check employment details such as the company name, address, and pay periods.

What are alternative methods to verify a pay stub?

You can verify pay stubs by cross-referencing them with tax documents like W-2 forms and reviewing bank statements for consistent income deposits. This can help ensure the accuracy of the pay stub.

About the author

Brianna Valleskey is the Head of Marketing at Inscribe AI. A former journalist and longtime B2B marketing leader, Brianna is the creator and host of Good Question, where she brings together experts at the intersection of fraud, fintech, and AI. She’s passionate about making technical topics accessible and inspiring the next generation of risk leaders, and was named 2022 Experimental Marketer of the Year and one of the 2023 Top 50 Woman in Content. Prior to Inscribe, she served in marketing and leadership roles at Sendoso, Benzinga, and LevelEleven.

Learn More

Dive deeper into document processing

What will our AI Agents find in your documents?

Start your free trial to catch more fraud, faster.